AI and insurance agent: how AI agents speed work and cut errors

AI is reshaping how an insurance agent works day to day. AI uses natural language, machine learning and data analytics to read documents, score risk and assist customer conversations. AI agents automate repetitive tasks like form parsing, claims triage and basic underwriting checks. As a result, brokers and teams can focus on advice and relationship work rather than manual lookups. Also, 62% of independent agents have invested in AI technologies, which shows a rapid shift in brokerage tools and priorities (Nationwide survey). Furthermore, AI provides measurable gains: faster decisions, fewer manual checks and richer data enrichment that improves proposal accuracy.

To be concrete, AI systems combine natural language processing with predictive models to flag suspicious claims and to summarize long-policy documents. In addition, machine learning models update risk assessments as new claims data arrives, which helps underwriting teams underwrite more consistently. For example, insurers that use automation in quoting report much faster turnaround; some projects cut quote times by up to half (McKinsey). Thus, AI reduces human error while accelerating response times. Also, virtual assistants and AI agents can route complex email threads and resolve straightforward customer questions, which directly raises customer satisfaction and frees skilled staff for higher-value work. For teams that manage heavy email volumes, tools that automate the email lifecycle have a big impact. For instance, virtualworkforce.ai uses AI agents to automate the full email lifecycle for ops teams, which reduces handling time and improves consistency.

Finally, insurance teams that adopt AI see gains in operational efficiency and client service. Also, AI improves the accuracy of policy recommendations when systems integrate external data, and therefore they help agents give better advice. In short, AI is a tool that speeds work and cuts errors, while keeping human judgement central to complex decisions.

AI tool and agentic AI for insurance agencies: specialised tools that automate multi‑step workflows

Agentic AI suites go beyond single chatbots. An AI tool can be a simple assistant that drafts replies. In contrast, agentic AI coordinates multiple specialised agents to complete multi-step workflows. For brokers this matters because tasks like coverage-gap checks and contract comparisons require several discrete actions. For example, Zywave’s agentic suite runs research, performs coverage-gap analysis and then personalizes proposals, which reduces manual review and improves retention (Zywave). Also, these suites are designed for insurance agencies, so they come with pre-built domain logic and fewer tuning steps.

Choose industry-focused tools to reduce deployment time and to meet compliance needs. Also, agentic AI treats each step—data gather, validation, decision and communication—as an independent agent that can call data sources and then escalate when rules require human review. Consequently, a broker can automate complex flows while retaining audit trails. In practice, this reduces back-and-forth and speeds policy issuance. For example, teams that integrate document OCR plus task automation can move from manual intake to approved quote faster than before. In addition, agentic approaches make it easier to comply with audit and regulatory checks because each agent logs its actions and data sources. Therefore, agentic AI helps insurers and brokers maintain traceability without heavy custom engineering.

Also, tools like specialized agent suites reduce the need to build from scratch. For brokers who want faster wins, consider vendor suites that include underwriting connectors, fraud engines and customer-facing assistants. Further, internal teams can combine those suites with domain connectors. For logistics-heavy brokers, integration examples and guidance appear in resources like our guide on how to improve logistics customer service with AI (integration guide). Finally, agentic AI makes it practical to automate end-to-end processes, and thus it streamlines many tedious workflows that once consumed broker time.

Drowning in emails? Here’s your way out

Save hours every day as AI Agents draft emails directly in Outlook or Gmail, giving your team more time to focus on high-value work.

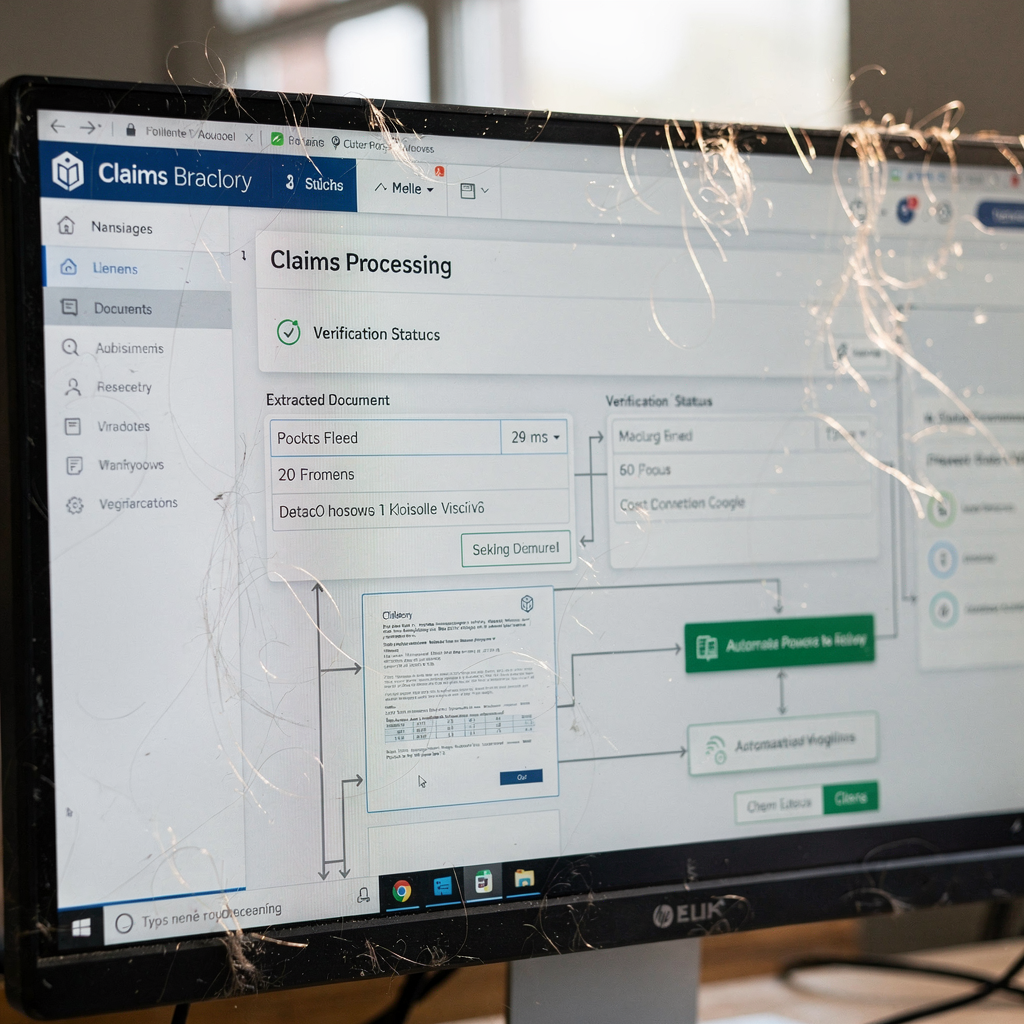

Automate claims processing and underwrite faster: automation that halves turnaround times

Automation and AI work together to speed claims processing and to reduce manual effort. AI models extract data from emails and forms, then feed rule engines and predictive models. Consequently, triage happens in seconds rather than hours. For example, intelligent automation in underwriting and quoting has reduced turnaround by up to 50% in some settings (McKinsey). Also, AI helps underwrite at scale by pre-filling applications, checking external data and ranking risk. As a result, teams can underwrite more policies with the same headcount and with fewer errors.

AI-driven fraud detection is another major gain. Machine learning detects patterns across large claims data sets and spots anomalies that humans might miss. Thus, AI improves fraud detection accuracy and reduces false positives, which saves money and preserves customer trust. Also, brokers benefit because cleaner claims data shortens resolution cycles and lowers operational costs. In addition, AI models provide confidence scores and explainability layers, which help compliance teams accept automated decisions.

To implement these gains, integrate OCR, data connectors and automated decision logic. For email-heavy processes, platforms that automate the full email lifecycle can extract required fields, match policy IDs and then either resolve or escalate. virtualworkforce.ai, for instance, connects ERP and email history to draft accurate replies and to route exceptions automatically, which reduces handling time per email and increases consistency. Also, when AI systems underwrite, they still escalate complex cases to humans. This hybrid approach keeps customer trust intact while boosting throughput. Therefore, combining AI with clear handover rules allows teams to scale without sacrificing quality.

Assistant and AI agent for the policyholder: improving service and conversion with conversational AI

Conversational AI and virtual assistants give policyholders 24/7 access to help. They answer routine enquiries, explain coverage and intake claims. Also, these systems can personalize recommendations by drawing on client profiles and market data. For instance, a conversational agent can guide customers through a business auto quote and then highlight endorsed coverages that match the client’s profile. As a result, first-contact resolution rates improve and conversion rises. In fact, generative AI tools help craft tailored proposals that resonate with prospects, which boosts insurance sales and customer satisfaction.

Integrate assistants with CRM and document systems to avoid data silos. Also, when an assistant drafts a reply, it should ground suggestions in verified sources to reduce errors. For operations teams that face high email volumes, a platform that routes or resolves emails automatically brings big gains. For practical examples and integration patterns, see our resources on automated logistics correspondence and email drafting for operational teams (automated correspondence) and (email drafting). These patterns apply to policyholder communications because the core problem is the same: many repetitive, data-dependent messages require fast, accurate responses.

Also, conversational AI improves accessibility. It can offer multi-channel support, handle attachments and then convert email content into structured claims data. Thus, teams capture accurate records for downstream processing. However, AI isn’t a full replacement for human empathy. Complex or emotionally charged claims still need human attention. Therefore, design assistants to escalate cleanly to a human with context and attachments. Finally, a well-integrated assistant increases engagement and helps personalize offerings, delivering measurable benefits for policyholders and brokers alike.

Drowning in emails? Here’s your way out

Save hours every day as AI Agents draft emails directly in Outlook or Gmail, giving your team more time to focus on high-value work.

Human agents, independent agents and insurance teams: can AI replace human agents?

Short answer: AI augments human agents rather than replacing them today. AI handles routine tasks and frees staff for judgement work. For independent insurance brokers and corporate teams, that means agents can focus on strategy, relationship building and complex risk conversations. Also, regulatory constraints and trust considerations limit where AI can act alone. For example, underwriting decisions that require nuanced judgement or that touch on legal clauses continue to need human sign-off. Therefore, the common pattern is hybrid: AI automates steps like document extraction, risk scoring and initial recommendations, and then humans finalize the outcome.

Independent agents have widely adopted AI to compete on speed and service. Also, the presence of AI in broker toolkits helps agents deliver more personalized insurance options by quickly combining internal policy rules with external data. Yet, some fear that AI will replace human agents. Evidence and expert commentary indicate the opposite: AI helps agents do more high-value work and it reduces time spent on routine tasks like email triage and form validation. For instance, firms that deploy AI agents for insurance often report productivity gains while preserving client-facing roles.

To manage the transition, define clear handover rules where AI escalates complex cases to human teams. Also, train staff on how to interpret model outputs and on how to address exceptions. In addition, include audit logs and explainability features so that humans can review AI recommendations. Finally, keep clients informed about when they are interacting with AI and when they will speak to a real person. This builds trust and ensures that human judgement remains central for complicated matters.

Implementing AI: insurance agents need a roadmap to build AI, pick the best AI tools for insurance and answer frequently asked questions

Start with a clear roadmap. First, map processes to identify where to automate. Next, clean and govern data so models have reliable inputs. Then, pilot with measurable KPIs such as time-to-quote, claims processing time and increase in policy uptake. Also, include compliance checks and escalation paths before you scale. Decide whether to buy a vendor solution or to build in-house. For many brokers, a mix works best: use specialised agentic suites for domain logic and in-house connectors for proprietary data.

Tool categories to consider include agentic AI suites, conversational assistants, document OCR plus RPA, underwriting models and fraud engines. Also, consider integration with your CRM and ERPs so the AI can read and write records. For logistics-focused examples, our piece on how to scale logistics operations with AI agents shows practical steps and ROI patterns (scaling guide). That article explains how platforms that automate email and operational tasks reduce handling time and errors. Use those lessons when deploying AI for insurance operations.

Quick FAQs: Expect costs to vary by scope, but many projects show fast payback when they reduce manual handling. Also, data privacy and compliance must be central; ensure your vendor supports governance and audit. Train staff and define escalation rules to prevent over-automation. Finally, monitor models in production and recalibrate them as claims data evolves. If you want specific tool recommendations, research best ai tools for insurance and select vendors that offer strong grounding in operational data and strong explainability features.

FAQ

What is an AI agent and how does it help insurance brokers?

An AI agent is software that performs defined tasks autonomously, such as extracting data or triaging claims. It helps insurance brokers by handling routine work, improving speed and reducing manual errors, which enables brokers to focus on client strategy and relationship building.

How widely have independent agents adopted AI?

Adoption has grown rapidly; for example, a survey found that about 62% of independent agents have invested in AI technologies (Nationwide). This shows that brokers are embracing AI to improve speed and competitiveness.

Can AI automate claims processing and underwrite faster?

Yes. AI can extract data, apply decision rules and prioritize cases for human review. In some settings, intelligent automation has reduced quote and underwriting turnaround by up to 50% (McKinsey), and similar gains are possible for claims processing.

Are conversational AI and virtual assistants reliable for policyholders?

They are reliable for routine enquiries and for structured intake such as initial claims information. However, they should escalate complex or sensitive issues to a human to preserve trust and to handle nuanced judgement.

Will AI replace human agents?

No, AI augments human agents today. It automates routine tasks so humans can handle complex judgement and client relationships. Hybrid approaches with clear handover rules are the prevailing model.

What steps should agents take when implementing AI?

Agents should map processes, clean data, pilot with KPIs, choose vendor or build decisions and then scale. Also, include governance, staff training and clear escalation policies before broad deployment.

What types of AI tools should brokers evaluate?

Look at agentic AI suites, conversational assistants, OCR plus RPA, underwriting models and fraud detection engines. Choose tools that integrate with your CRM and operational systems for the best results.

How does AI improve fraud detection?

Machine learning models detect patterns across large datasets and flag anomalies that suggest fraud. This reduces false positives and improves claim integrity when combined with human review.

How do I ensure compliance and data privacy when using AI?

Work with vendors that provide audit trails, data governance and explainability features. Also, limit model access to authorized systems and keep detailed logs of automated actions for audits.

Where can I learn more about integrating AI into operational email workflows?

For hands-on examples, see resources on automating logistics correspondence and email drafting, which translate directly to insurance operations and email-heavy workflows (automated correspondence) and (email drafting). These pages show how end-to-end email automation reduces handling time and errors.

Ready to revolutionize your workplace?

Achieve more with your existing team with Virtual Workforce.