AI agent intake: agents streamline data to underwrite faster

AI intake tools change how teams handle a submission. They collect documents, extract key fields and flag gaps. For example, an intake chatbot asks for missing medical histories and then pushes the files into a review queue. This helps underwrite faster. It also reduces time spent on manual data and repeated follow-ups.

In practice, AI agent pipelines combine OCR and named entity recognition. They convert scanned medical forms into structured records. They normalise freeform loss histories so an underwriter can read concise summaries. This makes the first pass quicker. As a result, the underwriting process moves from triage to decision more smoothly.

McKinsey reports that AI intake agents improve data collection and cut errors, which accelerates underwriting cycles (McKinsey). WNS signalled its intent to build these capabilities when it acquired Kipi.ai, showing market demand for agentic research and intake assistants (WNS). These moves confirm insurers value faster, cleaner submissions.

Agents streamline document analysis and data extraction. They call APIs to pull third-party records such as claims data and credit checks. They merge third-party feeds with application fields to produce a single dossier. This dossier highlights missing policy terms, risk factors and potential contradictions. Underwriters then review a focused bundle, which reduces repetitive checks.

AI systems are good at pointing out gaps. For instance, an intake agent flags when financial statements are not attached. It lists what is missing and suggests the minimum documents to underwrite. This lowers back-and-forth and speeds approval timelines. For operations teams that handle many submissions, using AI for insurance means fewer delays and fewer routing errors.

virtualworkforce.ai specialises in agent automation for operational email. Its approach shows how AI agents can parse incoming requests, route them and draft responses while preserving audit trails. Integrating similar intake agents into policy workflows can simplify processes and cut handling time without adding headcount. This frees underwriters to focus on complex decisions rather than manual data collection.

AI in insurance underwriting: automate data collection and risk assessment

AI in insurance underwriting automates routine data tasks and improves consistency. First, agents pull data from policy applications, medical records, claims data and public registers. Then, they normalise unstructured notes into standard fields. This reduces variability in how underwrite teams handle similar submissions.

Kalepa found that over 60% of insurers had integrated AI automation in underwriting by 2025, with forecasts to reach about 85% by 2027 (Kalepa). Celent reports that generative AI and other models improved risk prediction accuracy by roughly 25% and cut policy issuance time by about 30% (Celent). These are measurable gains that product and compliance teams can track.

For example, an agent can auto-populate underwriting cases with pre-scored risk bands. It can tag high-risk exposures for human review. It can also pre-fill policy parameters based on precedent. Each of these steps automates routine tasks and reduces manual entry errors. Thus, the underwriter spends less time on mundane updates and more time on judgement.

To illustrate, imagine a property submission. An agent extracts recent claims, vendor invoices and satellite imagery links. It produces a single risk profile with suggested policy terms. It highlights gaps in loss mitigation measures. The underwriter then confirms or adjusts the recommendations. This flow improves underwriting accuracy and shortens turnaround.

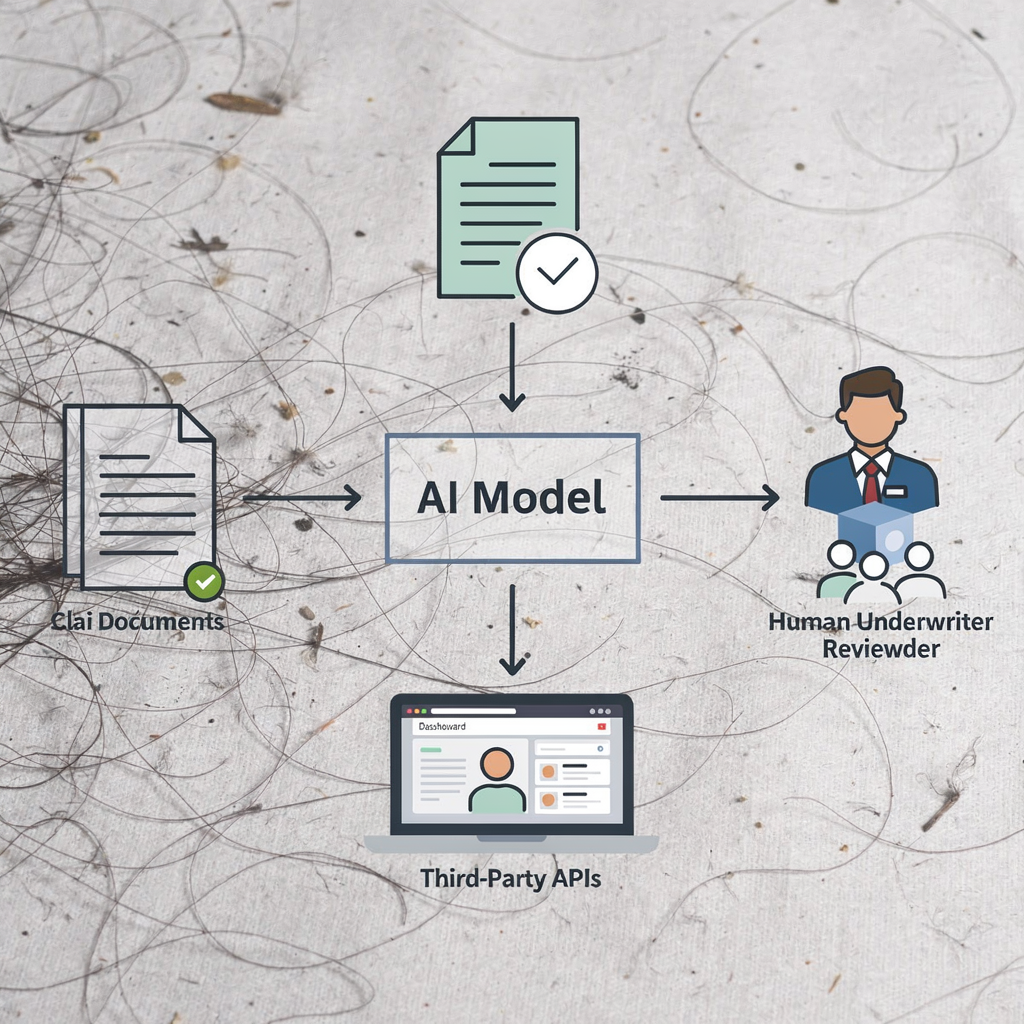

Visual aids help stakeholders. An infographic that maps data → model → underwriter clarifies how AI models feed decision support. Teams can monitor KPIs such as cycle time, hit-rate and underwriting accuracy. These metrics measure how AI-driven tools improve underwriting efficiency and reduce human error.

Drowning in emails? Here’s your way out

Save hours every day as AI Agents draft emails directly in Outlook or Gmail, giving your team more time to focus on high-value work.

Generative AI and AI underwriting: transform decision-making and cut bottleneck

Generative AI helps reduce the central underwriting bottleneck. It summarises long medical records, drafts rationale and suggests policy wordings. As a result, the underwriting team can process more files per day. It can also maintain consistent explanations for approval or declinature decisions.

Celent and other industry reports note that generative AI improves decision support and risk pricing. For example, models generate concise risk summaries that highlight key risk factors and claim history (Celent). WNS reports that agentic research assistants can cut underwriting research time by up to 40% (WNS). These savings translate directly into throughput gains.

Here is a short case study. A mid-sized insurer adopted an AI-powered research assistant to pre-summarise complex marine cargo submissions. Before, the team took four hours per file for deep research. After deployment, pre-summaries arrived in under one hour. Throughput rose by roughly 35%. Human underwriters still signed off on final pricing and approval. Human review remains mandatory for high-value or novel risks.

Practical examples include model-generated Q&A for brokers and automated policy drafts. An AI agent can answer broker queries about exposures and propose policy terms based on precedent. It can also flag when additional inspection is required. These tasks reduce the number of cases that reach the true bottleneck: human judgment on edge cases.

Teams must manage model outputs carefully. They should keep versioned ai models and clear escalation rules. They should also measure where generative AI adds value and where it introduces risk. That mix of AI support and human expertise delivers better outcomes for policyholder and insurer alike.

Automation, claims processing and credit teams: link underwriting to downstream workflows

Automation connects underwriting with claims and credit teams. When underwriters approve a policy, downstream teams need consistent risk scores and policy terms. An integrated stack shares those outputs. This reduces friction during claims handling and financial reviews.

McKinsey argues that AI intake and integrated stacks produce ecosystem benefits for insurers (McKinsey). Celent shows policy issuance time fell when underwriting and claims shared automated signals (Celent). These links lower cost and improve response speed for policyholder events.

For instance, a shared risk score feeds claims triage logic. Claims teams then prioritise large exposures. Credit teams receive alerts for accounts that exceed exposure thresholds. That signalling helps with credit decisions and reduces surprise losses. It also improves operational efficiency across departments.

Technically, this requires APIs and agreed message contracts. It also requires governance over data fields and model outputs. Teams should define a canonical risk profile that includes claims data, risk factors and predicted loss frequency. They should log every handoff so that auditors can trace decisions. This approach simplifies processes and supports regulatory compliance.

virtualworkforce.ai shows how operational email automation can form one part of the handoff. For example, automated data from inboxes can populate claim triggers or flag overdue financial statements. Systems can push structured summaries to credit teams and claims desks. This reduces manual tasks and ensures quicker responses without adding headcount.

Drowning in emails? Here’s your way out

Save hours every day as AI Agents draft emails directly in Outlook or Gmail, giving your team more time to focus on high-value work.

Regulatory compliance and human oversight: how to revolutionize safely

Regulators expect explainable and auditable AI. Firms must implement controls that preserve human oversight. They must also document decisions and provide clear escalation paths. That way, teams can adopt AI while meeting regulatory compliance obligations.

Start with model versioning and decision logs. For every automated recommendation, record the model version, input data and the final human action. Next, define escalation rules for borderline cases. Then, run periodic bias testing and monitor for drift. These steps create a traceable record that examiners can review.

Minimum controls should include access controls, audit trails and a human‑in‑the‑loop rule for high-severity decisions. Compliance teams should own review cycles and set tolerances for acceptable error rates. Product and data teams must collaborate to maintain documentation and to update policies when models change.

For example, an underwriting AI agent that suggests pricing should flag any deviation beyond agreed thresholds. A named underwriter should review such cases and record the rationale. That practice maintains accountability and limits human error. It also ensures that human expertise remains central when it matters most.

Firms must also consider data lineage and consent for third-party sources. They should map data from multiple sources and ensure that any automated data extraction meets privacy rules. Finally, document analysis processes should be auditable and repeatable. This safeguards policyholders and allows insurers to demonstrate compliant use of AI.

Future of underwriting: metrics, ROI and steps to transform and streamline operations

Measure pilot success with clear KPIs. Track cycle time, hit-rate, underwriting accuracy, false positives and regulatory incidents. Celent and industry surveys suggest that accuracy improvements and shorter issuance times provide clear ROI (Celent). Kalepa and McKinsey forecast larger adoption and ecosystem benefits (Kalepa) (McKinsey).

Begin with a 90-day pilot. First month: connect data sources and run baseline reports. Second month: deploy AI agents to automate routine tasks. Third month: measure impact and refine rules. This pilot should test automated data extraction, document analysis and model outputs. It should also verify that human review works for exceptions.

KPIs to track include time saved per submission, improved underwriting accuracy and fewer manual tasks. Also track the percentage of submissions that move straight to approval without further inquiry. These measures show how agents streamline operations and deliver operational efficiency.

For scaling, follow the roadmap: pilot → embed → scale. Embed automation into core underwriting workflows and then extend to claims and credit teams. Ensure governance and monitoring scale with the platform. That way, you can deploy AI agents across lines of business while controlling risk.

Three next actions are clear. Underwriters should map the highest-volume submissions to identify time-consuming steps. IT should plan secure connections to source systems and APIs. Compliance should set controls and acceptance criteria for model outputs. Together these steps will improve underwriting efficiency and help insurers harness the power of AI agents to transform how they assess and price risk.

FAQ

What is an AI agent in underwriting?

An AI agent is a software component that automates specific underwriting actions. It may collect documents, extract fields and prepare summaries for human review. These agents reduce manual data collection and help underwrite more quickly.

How do AI intake agents speed data collection?

Intake agents use chat interfaces, OCR and API pulls to gather information. They spot missing attachments and request them automatically. This reduces back-and-forth and shortens the time from submission to decision.

Will AI replace human underwriters?

No. Evidence shows a collaborative model where human expertise remains essential. AI reduces routine work and frees human underwriters to focus on complex or novel risks.

What measurable benefits can firms expect from AI?

Reports show improvements such as a 25% lift in prediction accuracy and a 30% cut in issuance time in some cases. Other firms report up to 40% faster research when using agentic assistants. These figures depend on the scope of deployment.

How should teams manage regulatory compliance when using AI?

Teams should implement versioned models, decision logs and human‑in‑the‑loop rules. They should also run bias tests and maintain data lineage for third-party sources to meet regulator expectations.

Can underwriting automation link to claims processing?

Yes. Shared risk scores and structured outputs can feed claims triage and credit teams. Proper APIs and governance are required to ensure reliable handoffs and to simplify processes.

What is a sensible pilot for underwriting AI?

A 90-day pilot that connects data sources, deploys intake agents and tracks KPIs is sensible. Focus on high-volume submission types and measure cycle time, accuracy and exception rates.

How do generative AI tools help underwriters?

Generative AI summarises long documents, drafts rationale and suggests policy wordings. It speeds decision-making and reduces the common bottleneck where underwriters must read lengthy files.

What technical work is needed to deploy AI agents?

IT must connect systems, provide secure APIs and set access controls. Data teams should normalise unstructured inputs and ensure automated data extraction feeds downstream systems reliably.

Where can I learn more about practical automation for operational emails and workflows?

virtualworkforce.ai specialises in agent automation for the full email lifecycle and operational workflows. See examples of email drafting and automation for logistics and operations to understand how similar patterns apply in underwriting. For related resources, explore automated logistics correspondence, and how to scale logistics operations with AI agents.

Ready to revolutionize your workplace?

Achieve more with your existing team with Virtual Workforce.