ai + real estate investment: How AI speeds market analysis and deal sourcing

AI processes far more data than a human team can review. As a result, real estate investment teams can identify opportunities faster and with greater confidence. In practical terms, firms report up to a 30% improvement in investment accuracy and a roughly 25% reduction in due diligence time. These figures show why investors now prioritise speed and precision.

Data sources matter. Modern pipelines ingest listings, transaction histories, demographics, mobility patterns and macroeconomic indicators. Then, models turn those feeds into signals. Supervised models deliver property-level valuation and price forecasts. Unsupervised clustering segments neighbourhoods by demand and supply. Natural language processing extracts terms and sentiment from listings, local news and broker notes. Together, these methods let teams compare a large set of deals in hours rather than days.

Tools vary from bespoke regression models to off-the-shelf machine learning platforms. For valuation tasks, supervised learning reduces manual bias and tightens error bands. For sourcing, clustering and classification flag target properties that match investor criteria. NLP finds terms that indicate hidden value or risk. Firms that use AI-driven screening shorten sourcing cycles and improve hit rates. For example, some boutique funds that adopted structured AI saw faster deal triage and higher conversion to LOI.

AI also links to operational automation. Systems that route data and draft summaries reduce repetitive work. Our company, virtualworkforce.ai, automates the email lifecycle that crosses many operational silos. That capability matters when brokers, asset managers and legal teams exchange deal documents. When emails stop being a bottleneck, teams move faster and focus on deal analysis.

From a product view, a simple flowchart shows this path: data sources → model training → signal generation → deal evaluation. Visualising that pipeline helps stakeholders align on priorities and resources. For teams that want examples of rapid scaling and automation in adjacent sectors, see how logistics teams scale with AI agents without hiring. Overall, use AI to reduce manual triage, accelerate sourcing and improve signal quality while keeping humans in the loop.

ai in real estate for commercial real estate: Valuation, forecasting and predictive analytics

Valuation improvements and robust forecasting make AI essential in commercial real estate. First, valuation: AI models trained on transaction histories can tighten error ranges. In practice, implementations have improved accuracy by roughly 18%. That level of precision raises investor confidence when underwriting new assets.

Forecasting rent and vacancy is another core use-case. Machine learning models ingest macro shocks, employment data and local supply pipelines to run scenario analysis. As a result, asset managers can stress-test portfolios under plausible economic paths. McKinsey highlights how AI-driven predictive analytics cut downside risk by up to 20%. These tools let teams spot overvalued assets sooner.

Site selection benefits from layered analysis. By combining amenity maps, transport networks and demographic trends, AI improves precision when choosing development or acquisition targets. Studies show neighbourhood-level comparisons can boost site selection accuracy by more than 20% in targeted tests. For firms focused on commercial real estate, that precision translates to better cap rate management and tenant mix planning.

Use-case: CBRE piloted generative AI tools to summarise asset reports and run alternative portfolio mixes. The pilots produced faster, data-driven decisions and clearer trade-offs for portfolio managers. CBRE reports better decision cadence from combining generative and predictive systems when applied thoughtfully. That example shows how generative AI complements numeric forecasts by producing readable summaries and options.

Practical subheads:

Valuation: Improved accuracy and faster appraisal cycles using supervised models and structured comparables. Forecasting: Rent and vacancy predictions that include macro stress testing. Site selection: Layered geospatial analysis with amenity and transport data for higher hit rates. Each of these use cases uses a mix of AI techniques and domain rules. For teams that want to test similar capabilities in operations and correspondence, our resource on automated logistics correspondence provides a useful parallel here. By blending models with rules and human checks, commercial teams can achieve measurable gains while keeping oversight.

Drowning in emails?

Here’s your way out

Save hours every day as AI Agents label and draft emails directly in Outlook or Gmail, giving your team more time to focus on high-value work.

real estate investment firms: Automate workflows with agentic systems and ai toolkits

Agentic AI and assistive tools sit on a spectrum. Agentic systems act autonomously to execute tasks. Assistive tools support humans with faster insights. Both types can streamline deal pipelines. For example, an agent can pre-screen deals, gather documents and draft an LOI for human review. That approach helps teams scale sourcing without adding headcount.

Key practical automations include screening deals, drafting LOIs, generating portfolio rebalancing signals and running compliance checks. A pilot might automate the pre-screening of 100 deals per week and surface the top five for senior review. In that pilot, the agent extracts key terms, scores risk and drafts a one-page summary for the asset manager. The human then confirms or rejects the lead.

Build a reliable toolchain. Start with data ingestion and enrichment. Next, move to model training and MLOps for reliable deployment. Then add user-facing dashboards and human-in-the-loop checkpoints. Finally, include approvals, audit trails and monitoring. McKinsey documents the productivity gains when firms pair modelled outputs with governance and MLOps practices for scale. That structure cuts risk while preserving speed.

Risk controls are essential. Include approval gates for acquisition and underwriting. Add versioned model logs and alerting for drift. Ensure every automated decision has a clear escalation path. A compact implementation checklist follows:

Implementation checklist: 1) Define decision points to automate. 2) Inventory and connect data sources. 3) Run a 90-day pilot with clear KPIs. 4) Add human checkpoints and SLAs. 5) Deploy MLOps and audit logging. For teams evaluating agentic ai, consider linking pilot outcomes to ROI analyses such as our logistics ROI study for comparable metrics. That example helps stakeholders visualise potential productivity gains.

Finally, an operational note: combine agentic AI with assistive workflows to keep control. Agentic systems should handle routine triage and structured tasks. Humans should underwrite material decisions. This balance lets firms automate repetitive work while protecting capital and reputation.

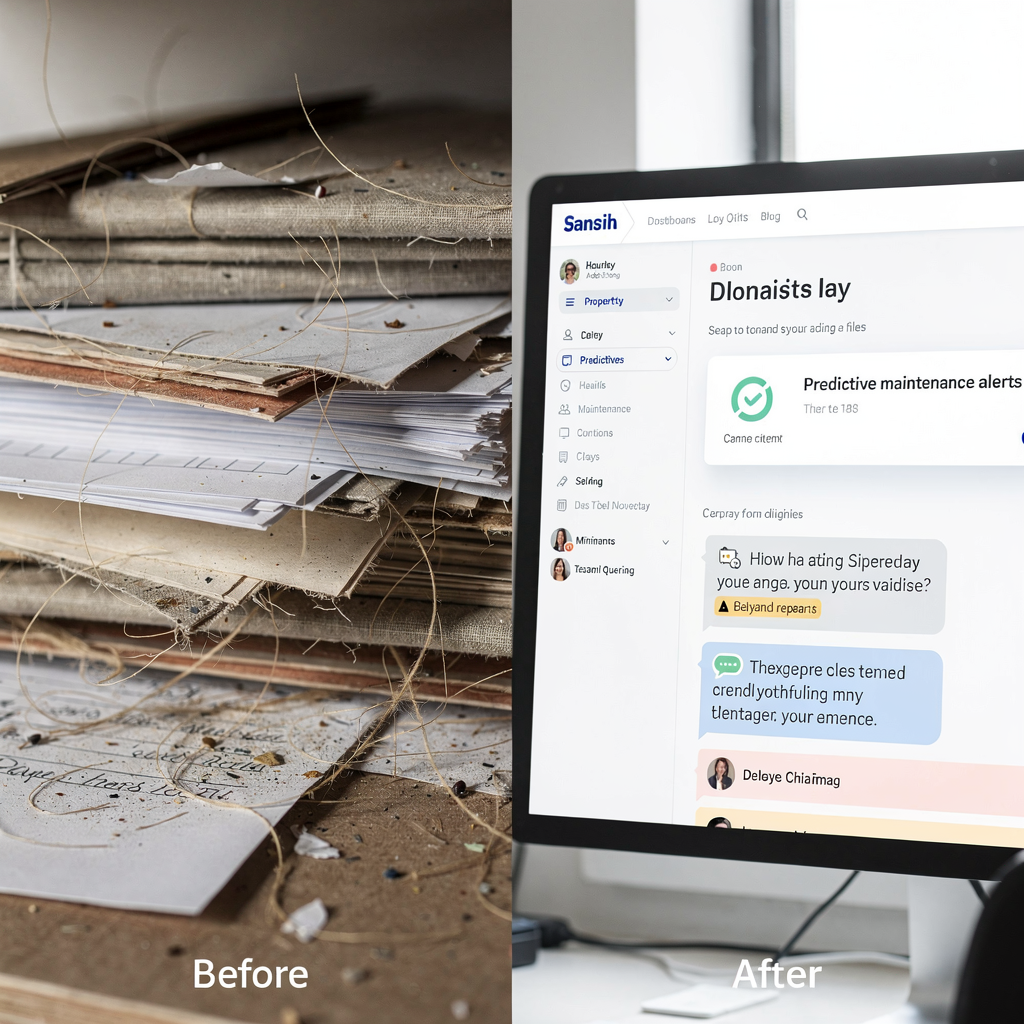

streamline operations: ai-driven property management, tenant screening and maintenance

AI-driven property management reduces costs and improves service. Tenant screening automations combine credit scoring, background checks and rental history to speed decisions. Automated scoring reduces manual bias and produces consistent results. Vendors claim tenant screening and workflow automation lead to faster lease cycles and fewer avoidable errors.

Predictive maintenance pairs IoT sensors with machine learning. Models forecast equipment failures and flag service needs before they disrupt tenants. This approach reduces reactive repairs and lowers total maintenance spend. Reported savings across vendors range between 15–20% in operational costs when teams deploy predictive maintenance and automation together with clear KPIs. Teams reduce downtime and preserve asset value.

Leasing and marketing also benefit. Generative AI writes listing copy and personalises outreach. Chatbots respond to tenant enquiries 24/7 and pass qualified leads to humans. Dynamic pricing engines change rent offers based on local demand curves. Those systems move faster and match market conditions more closely.

Operational procurement tips: run vendor trials with defined KPIs. Start with a narrow scope: tenant screening or maintenance scheduling. Measure baseline metrics and compare after 60–90 days. Ask vendors for audit access and clear SLAs. For document-heavy processes such as lease abstraction, test ai lease abstraction on a representative sample before broad rollout. If your teams handle high email volumes, our product automates the full email lifecycle and trims handling time significantly; read about automating logistics email drafting here for an operational example.

Practical vendor trial tips: 1) Define KPIs such as response time, repair cost and occupancy days. 2) Run A/B tests across similar portfolios. 3) Check data privacy practices and tenant consent. These steps reduce procurement risk and speed value realisation.

Drowning in emails?

Here’s your way out

Save hours every day as AI Agents label and draft emails directly in Outlook or Gmail, giving your team more time to focus on high-value work.

real estate industry risks and governance: Data quality, model transparency and best ai practices

AI brings measurable benefits, but also potential risks. Core risks include poor data quality, model drift, opaque models and regulatory exposure. Zillow’s caution about automated valuations illustrates the limits: their estimates offer a helpful guide but do not replace professional appraisal when a property is unique or high-end according to industry analyses. That caution applies across the real estate industry.

Follow practical governance steps. First, maintain data lineage so teams can trace inputs. Second, require explainability for models that affect pricing or tenant outcomes. Third, run periodic validation tests to detect drift. Fourth, embed human oversight and escalation policies. These measures lower reputational and regulatory risk.

Privacy and compliance matter. Protect tenant data under applicable rules, including GDPR-like regimes in the EU and UK. Include strict access controls and anonymisation where possible. Contractually, insist on audit access and clear SLA clauses when you use third-party models or data providers. For procurement, use a checklist that covers proof-of-concept metrics, audit rights and data handling obligations.

When to flag AI valuations for professional appraisal: flag any instance where the model shows high uncertainty, when comparables are sparse, or when unique features exist. Use transparency reports to show decision rationale to internal stakeholders. Test for bias using representative datasets and document the test results.

Action points for legal and compliance teams: 1) Require model documentation and test logs. 2) Define escalation routes and human approvals for sensitive outputs. 3) Set retention and deletion rules for tenant records. These basics help firms manage the potential risks of implementing AI at scale.

Implementing AI at scale for real estate investment firms: Roadmap, ROI and next steps

Start with a phased roadmap. Begin with discovery and a data audit. Then run a short pilot that focuses on measurable KPIs. Next, scale successful pilots by investing in MLOps, integrations and governance. Finally, iterate with continuous improvement cycles. This path balances speed and control.

KPI selection guides success. Track hit rate, time-to-deal, hours saved in due diligence, valuation error and operational cost reductions. Typical pilot costs vary by scope, but many teams reach break-even within 6–12 months when pilots target high-volume, low-complexity tasks. McKinsey cites significant productivity gains when firms standardise model deployment and integrate AI outputs into workflows for scale.

Define roles early. You need data engineers, ML engineers, product managers and domain specialists such as asset managers and compliance leads. For rapid pilots, assign a single product owner who can coordinate across teams. Budget for software development, data licensing and change management. For correspondence-heavy processes, consider solutions that automate the email lifecycle to free ops teams for high-value work; our guide on virtual assistants for logistics shows how email automation drives measurable savings in adjacent operations.

90-day pilot template: week 1–2 discovery and KPI setting; week 3–6 data preparation and model build; week 7–10 testing and human-in-loop tuning; week 11–12 go/no-go review and deployment planning. Measure outcomes against baseline and capture a clear ROI narrative. For leadership, focus on efficiency gains, reduced time-to-deal and improved valuation accuracy. Also highlight competitive advantage: well-governed AI can help teams move faster and source higher-quality deals.

Finally, summarise practical next steps: run a data audit, select a narrow pilot, define KPIs, secure governance and choose vendors with audit rights. If you want to discover how AI can integrate into operations and customer correspondence, discover how AI agents automate the full email lifecycle and reduce handling time across complex systems. That step often unlocks further automation opportunities and accelerates value capture.

FAQ

What is AI for real estate investment?

AI for real estate investment describes tools that help analyse markets, value assets and automate repetitive tasks. It includes models for valuation, forecasting and document analysis to support faster decision-making.

How does AI speed up deal sourcing?

AI ingests listings, transaction data and demographic feeds to score and rank opportunities. It reduces manual triage so teams can evaluate more deals in less time.

Can AI replace human underwriters?

No. AI automates routine analysis and highlights risks, but humans still underwrite material decisions. Use AI to automate pre-screening and to produce summaries for underwriters.

What are common AI risks in property valuation?

Risks include poor input data, model drift and opaque reasoning. Models can misprice unique properties, so firms should flag uncertain outputs for professional appraisal.

How do you run a successful AI pilot?

Define clear KPIs and limit the pilot scope. Prepare data, set human checkpoints and measure results against baseline. Use a 90-day template to keep the pilot focused and measurable.

What is agentic AI in real estate?

Agentic AI refers to autonomous agents that execute tasks such as deal pre-screening or document gathering. They act with limited human prompts but should include approval gates.

How can property managers benefit from predictive maintenance?

Predictive maintenance uses sensors and models to forecast failures, allowing teams to schedule repairs proactively. This reduces downtime, cuts repair costs and improves tenant satisfaction.

What governance practices should firms adopt?

Adopt data lineage, explainability, bias testing and periodic validation. Require audit access from vendors and maintain human oversight for sensitive outputs.

Which teams are needed to scale AI?

Build a cross-functional team with data engineers, ML engineers, product managers, asset managers and compliance leads. Assign a clear product owner for each pilot.

How do I evaluate vendors for AI solutions?

Assess vendors on proof-of-concept metrics, SLA terms, audit access and data handling practices. Run a small trial with measurable KPIs before committing to broader deployment.

Drowning in emails?

Here’s your way out

Save hours every day as AI Agents label and draft emails directly in Outlook or Gmail, giving your team more time to focus on high-value work.