AI in finance: why investment firms are building AI platforms now

Investment firms are accelerating AI investment now. First, budgets are rising. For example, “88% of senior executives say their teams plan to increase AI-related budgets in the next year, signaling widespread recognition of AI’s critical role in competitive advantage” PwC (May 2025). Next, consulting work highlights pockets of value. In mid-2025 McKinsey identifies clear opportunities in distribution flows and investment process efficiency McKinsey (Jul 2025). Therefore, firms combine strategy and engineering to capture returns.

To be precise, AI differs from plain generative tools. Generative models synthesize text or scenarios. In contrast, a platform plus agentic capability integrates autonomous reasoning, monitoring, and action. Agentic AI adds autonomy and a continuous feedback loop. As a result, firms move from simple model outputs to agentic systems that can identify signals and execute within guardrails. The shift enables agents to analyze market data, adjust trading strategies and manage trade lifecycle in production.

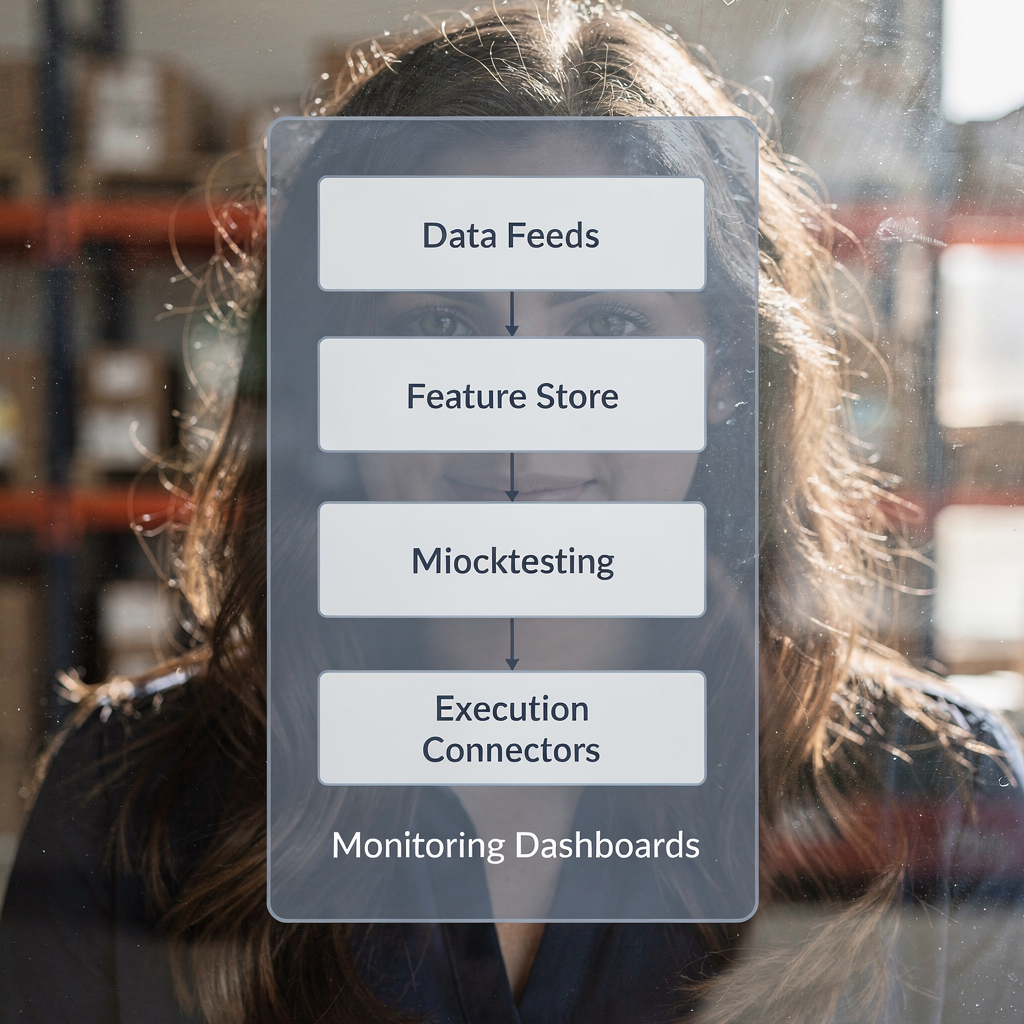

Platform components matter. Real deployments require robust real-time feeds, feature stores, execution connectors, observability and a model registry. In practice, teams must provision data ingestion, low-latency market connections and audit trails. Also, firms decide between vendor stacks like DataRobot or AutoML tools and bespoke in‑house trade‑execution systems. Vendor solutions speed development. Conversely, in-house stacks offer custom connectivity and precise latency controls that many financial institutions prefer for execution and liquidity management.

Furthermore, operations benefit too. For example, ops teams that automate emails with end-to-end agents show measurable ROI; readers can review enterprise examples of email automation for ops to compare architectures automated logistics correspondence. Also, firms should plan governance and an engineering roadmap. In short, firms build an AI platform now to capture alpha, streamline investment workflows, and meet regulatory requirements while they scale.

AI agent and agentic AI: how autonomous agents change portfolio management

Define the terms simply. An AI agent is an autonomous component that senses, reasons, and acts within constraints. Agentic AI layers those agents into workflows that adapt and coordinate. Agentic AI systems can run continuous scenario analysis. They can detect regime shifts and propose rebalancing. As a result, portfolio teams get faster signal detection and the ability to perform intraday portfolio rebalancing.

Practically, agent design matters. Single-task agents focus on one goal, such as signal generation or execution. Manager–executor multi-agent patterns pair a manager agent with executors that place trades. Also, human-in-the-loop control keeps humans in supervisory roles for risky actions. In short, design choices affect latency, safety, and explainability.

Evidence shows a gap between adoption and value capture. McKinsey describes an “agentic factory” approach and found only roughly 6% of firms capture large financial returns from advanced AI deployment McKinsey (mid‑2025). Therefore, many teams invest without securing execution or governance. The lesson is clear. Firms need end‑to‑end engineering, evaluation metrics, and production controls to turn prototypes into profits.

Also, agentic AI is transforming execution and monitoring in live markets. Agentic AI is transforming how teams approach risk and speed. For example, AI agents work alongside portfolio managers to run continuous stress tests and to optimize trading strategies in volatile conditions. Importantly, AI agents don’t act without guardrails. Teams must predefine risk budgets, kill switches, and human override paths.

Finally, practical patterns help firms scale. Start with clear objectives, then choose an architecture that supports single-task proofs and multi-agent coordination. Market volatility demands resilient designs. Meanwhile, teams should track model drift and decision-making quality. If you want to explore how AI agents can support operational flows, consider examples of AI-driven email automation for operations to understand how agents handle complex tasks and data retrieval how to scale logistics operations with AI agents.

Drowning in emails?

Here’s your way out

Save hours every day as AI Agents label and draft emails directly in Outlook or Gmail, giving your team more time to focus on high-value work.

AI agents in financial services: practical use case for automated execution and monitoring

Teams deploy AI agents in financial services to automate parts of the trade lifecycle. The central use case is autonomous execution with strict risk thresholds. First, agents ingest market data and alternative sources to identify alpha signals. Then, they back-test and paper trade. Finally, with approvals, agents execute live trades while enforcing pre-trade checks. This flow limits human error and reduces latency.

To illustrate, imagine a concrete pipeline. Signal generation takes external data, news, and market data and scores opportunities. Next, the system back-tests the signal and runs simulations. Then, the agent papers trades and reports performance. After satisfying governance gates, the agent places live orders and continuously monitors slippage and liquidity. This sequence improves speed and precision while preserving auditability and clear audit trails.

Evidence and pilots reinforce feasibility. Industry pilots in 2024–25 showed autonomous execution prototypes that cut decision latency and automated rule enforcement for compliance. Citigroup highlights that rapid adoption must sit inside robust risk and control frameworks Citi (Oct 2025). Also, practitioners cite governance as the main limiter rather than pure technology.

Operational requirements are non-negotiable. Pre‑trade checks, kill switches, trade audit trail and clear permission controls must exist before any agent may execute. Additionally, explainability logs, rollout approvals and rollback procedures support post‑trade forensics. Teams must also ensure connectivity to OMS/EMS and to custodians so orders execute and settle reliably in stressed market conditions.

Finally, the pipeline above benefits from automation of routine communications and ingestion tasks. For example, back-office teams automate reconciliation emails and data pushes to ERP systems using agentic integrations. If you want an example of integrating AI with ERP or shared inboxes, review end-to-end email automation case studies that show how agents create structured data from unstructured messages ERP email automation for logistics. The result is smoother control, reduced manual triage, and faster time to insights.

Portfolio: building automated strategies and integrating AI platform for live trading

Constructing automated portfolio strategies requires clear layers. Start with data ingestion, then feature engineering, modeling, back‑testing, optimisation, and finally execution. Each layer must include versioning, observability and rollback paths. Also, teams set throughput and latency targets to match trading tempo. For lower-frequency strategies, throughput matters but latency demands relax. For intraday strategies the reverse is true.

Data is foundational. Feed both internal and external sources, then standardize fields and timestamps. Use feature stores for reusability. Also, use retrieval-augmented generation to combine historical pricing, research, and alternative signals into model inputs. Then, build ai models that score risk and expected return. Afterward, simulate with stressed scenarios and track portfolio rebalancing effects on liquidity and market impact.

Engineering and ops tasks include versioned models, canary deployments, and order‑routing contingency plans. Metrics to track are Sharpe, drawdown, slippage, model drift and prediction confidence. Also, monitor auditability and post‑trade analytics. For execution, connect to OMS/EMS and custodians. Ensure order routing is resilient and that fallback routes exist when primary venues degrade.

Integration examples help. Signal providers plug into the platform to deliver alpha feeds. An OMS channels orders to execution brokers. Custodians provide settlement state. For firms that want to streamline client relationships and reduce manual replies, agents can push notifications and draft investor updates automatically, improving customer lifetime value. Also, teams should instrument llms carefully when they generate human-facing text to avoid AI-generated errors.

Finally, maintain a living framework for model validation and rollout. Track measurable KPIs during paper trade and during limited live execution. Use canary trades to test order sizing and market conditions. For teams managing operations or customer messaging, look at guided examples of how to scale operations without hiring, to see how agents handle high email volumes while remaining auditable how to scale logistics operations without hiring.

Drowning in emails?

Here’s your way out

Save hours every day as AI Agents label and draft emails directly in Outlook or Gmail, giving your team more time to focus on high-value work.

Risk management: governance, model risk and cyber controls for AI agents

Risk is central when agents operate in markets. Identify principal risks up front. Model bias and overfitting create poor decisions. Self‑evolving model drift can amplify errors. Cybersecurity threats may target execution connectors. Also, systemic amplification can emerge when many agents act similarly. Therefore, build a governance checklist and a control program.

Start with documented risk appetite for autonomous actions and clear human oversight points. Define rollout approvals, rollback procedures and frequent model validation cycles. Include stress tests and post‑trade forensics so you can trace decisions. Regulation demands explainability logs and change logs for audit. Industry guidance recommends balancing light‑touch governance with robust monitoring, as Citi and PwC note in their recent reports Citi (Oct 2025) and PwC (May 2025).

Operational controls must include permission controls, kill switches and continuous monitoring. Also, enforce predefine limits for position sizes and stress thresholds. Keep an immutable audit trail for every decision. That audit trail should include model versions, input snapshots, and the prompt that triggered any human-facing output. Audits and compliance reviews benefit from clear logs and from regular validation of data pipelines.

Cyber controls are important as well. Isolate execution connectors and apply zero‑trust access. Segment networks and encrypt sensitive financial data. Conduct red-team exercises and tabletop simulations to stress both model and ops responses. In addition, include third‑party risk management for vendors who provide AI tooling or market feeds.

Finally, embed governance into the engineering lifecycle. Require signoffs before any agent can execute. Also, keep a human-in-the-loop for high‑impact decisions, and set measurable KPIs for pilot phases. This approach helps teams identify opportunities to optimize while maintaining regulatory requirements and strong risk management across the portfolio and trading lifecycle.

Future of AI and how AI agents work together with humans to deliver alpha at scale

The future of AI in investment management will emphasize augmentation rather than replacement. Firms will invest rapidly in agentic capabilities, but value capture will depend on integration, control, and human teaming. Expect more multi-agent coordination and deeper human oversight. In practice, agents will handle routine signal detection and execution scaffolding, while humans focus on strategy and exception handling.

Best practice for human–agent teaming includes decision support dashboards, confidence intervals, and clear human override. Also, schedule periodic model reviews and mandate human signoff for new live strategies. Agents should surface ranked actions and provide reasoning traces so portfolio managers can decide quickly. This human–agent pairing improves decision-making while preserving accountability.

Operationally, firms should follow a checklist when starting now. Define a high-value use case, secure data sources, choose an AI platform architecture, establish governance and pilot with measurable KPIs. Track me as you test: Sharpe, slippage, prediction confidence and model drift. Also, be ready to iterate fast and to integrate feedback from traders and compliance.

Strategic implications matter. Agents are transforming financial services and agents are transforming financial services industry norms. However, agentic AI is transforming the mechanics of execution and monitoring. As firms scale, expect improved speed and precision and better client relationships through faster reporting and more personalized communications. For teams that handle heavy email volumes and operational tasks, examples of end-to-end email automation show how to streamline workflows and improve response times while maintaining auditability how to improve logistics customer service with AI.

To wrap up with practical steps, define scope, secure governance, instrument metrics, and pilot in low-risk settings. Also, remember that artificial intelligence will augment human judgement, streamline traditional automation, and help identify alpha in noisy markets. Firms that pair agents with strong oversight will enhance accuracy, manage market volatility, and scale portfolio operations without exposing themselves to undue model or cyber risk.

FAQ

What is an AI agent and how does it differ from an AI system?

An AI agent is an autonomous component that senses inputs, reasons, and acts within defined guardrails. By contrast, an AI system can be broader and may include models, data pipelines, and monitoring tools. An AI agent typically makes discrete decisions or takes actions, while an AI system is the full stack that supports those agents.

How do AI agents improve portfolio management?

AI agents accelerate signal detection and enable intraday portfolio rebalancing with consistent rules. They also run continuous scenario analysis to surface risks and trading opportunities, which helps managers act faster and with more confidence.

Are AI agents safe to let execute trades automatically?

They can be safe if firms implement strong controls such as pre‑trade checks, kill switches, permission controls and human oversight points. Auditable logs and rollback procedures are essential before any agent may execute live orders.

What governance practices should firms adopt first?

Start by documenting risk appetite for autonomous actions and setting rollout approvals and rollback procedures. Then add model validation cycles, stress tests, explainability logs and clear human oversight for high‑impact decisions.

How does an AI platform connect to execution systems?

An AI platform typically connects to OMS/EMS and custodians via execution connectors and APIs. It must support order routing contingencies and monitor settlement state to ensure reliable execution under varying market conditions.

Can AI agents handle external data like news or ESG signals?

Yes. Agents ingest external data sources, combine them with internal financial data and run retrieval-augmented generation or feature engineering to produce inputs for models. These inputs can help identify alpha in noisy signals and adjust for esg or liquidity constraints.

What metrics should teams track during pilot stages?

Track both performance and health metrics such as Sharpe, drawdown, slippage, model drift, and prediction confidence. Also include operational KPIs like latency, throughput and the number of manual escalations to measure automation impact.

How do firms balance speed with regulatory requirements?

They balance speed by embedding compliance checks into the agent workflow and by maintaining explainability logs and audit trails. Regular audits and post‑trade forensics help satisfy regulators while preserving execution speed.

What are common design patterns for agentic deployments?

Common patterns include single-task agents for focused functions and manager–executor multi-agent designs for coordination. Human‑in‑the‑loop patterns add oversight and are useful for high‑risk or novel strategies.

Where can teams find examples of practical integrations?

Operations teams can review case studies of end-to-end automation for insights on data grounding and auditability. For instance, automated logistics correspondence and ERP email automation examples illustrate how agents create structured output from unstructured inputs and streamline workflows automated logistics correspondence, ERP email automation for logistics.

Drowning in emails?

Here’s your way out

Save hours every day as AI Agents label and draft emails directly in Outlook or Gmail, giving your team more time to focus on high-value work.