ai agent for CRE underwriting: use AI-powered valuation and analytics to speed decisions

Underwriting in commercial real estate moves faster when teams use AI to automate data ingestion, comparables, cap‑rate models and scenario testing. In practice, an AI agent ingests public records, rent roll schedules and broker comps, then runs a valuation model to produce an initial price range. The purpose is to cut time‑to‑underwrite and increase consistency, and to let analysts focus on judgement instead of repetitive tasks. First, automated data pipelines pull feeds. Next, machine learning enriches priors and corrects for local idiosyncrasies. Then, an AI tool runs ensemble forecasts to test upside and downside scenarios. Finally, the investment memo is drafted and shared for review.

Generative AI and traditional ML both improve valuation accuracy and scenario testing. McKinsey notes that investors can customize models on proprietary data to scale opportunity identification across portfolios (McKinsey). Industry reports also estimate multi‑billion dollar efficiency gains for the real estate sector from these approaches (Morgan Stanley). Those figures support a business case: faster decisions reduce funding costs and let firms underwrite more deals per analyst.

Examples exist across asset classes. Multi‑family platforms use ML to forecast rent growth and vacancy, while office underwriting combines local employment metrics with cap‑rate trends. Skyline AI and other firms illustrate ensemble models plus local market feeds. A practical underwriting workflow starts with data collection, then applies a valuation model, then runs sensitivity tests, and finally delivers an investor memo. Metrics to track include time per deal, variance versus market comps, forecast error and hit rate on accepted bids. Tracking these KPIs shows whether AI-powered real estate tools actually improve outcomes.

Risk controls are essential. Implement human review thresholds for large deviations. Maintain provenance logging for every input and version control for models. Use clear guardrails so committees can trust the numbers. For teams exploring options, decide between best ai vendors or custom builds based on data scale and product roadmap. In short, using AI for underwriting can streamline approvals and boost deal throughput while preserving governance and explainability for real estate professionals.

ai tool for due diligence and document processing: automate lease abstraction, title and financial review

Due diligence often stalls deals. Teams must review leases, title reports, financial statements, capex schedules and rent roll documents. A focused AI tool can automate many document tasks and reduce hours of manual review. The practical stack runs OCR to extract text, applies NER to find clauses and then uses retrieval with generative responses for Q&A. This document processing pipeline helps teams standardise diligence and avoid missed liabilities.

Begin with OCR and structured extraction. Then apply a named‑entity approach to tag covenant language, renewal options, and termination triggers. Next, connect a retrieval‑augmented generation loop for interactive questioning about odd clauses. That RAG layer enables an analyst to ask natural questions and receive grounded answers with links back to source pages. The result is a clear diligence report that accelerates closes and reduces surprises.

Outcomes include faster closes, fewer missed liabilities, and standardised diligence reports across the portfolio. Add risk controls by setting human review thresholds where the model confidence is low. Log provenance for every extracted clause, and set red‑flag alerts when unusual language appears. This approach mirrors what leading AI-powered teams do when they automate lease abstraction and title review.

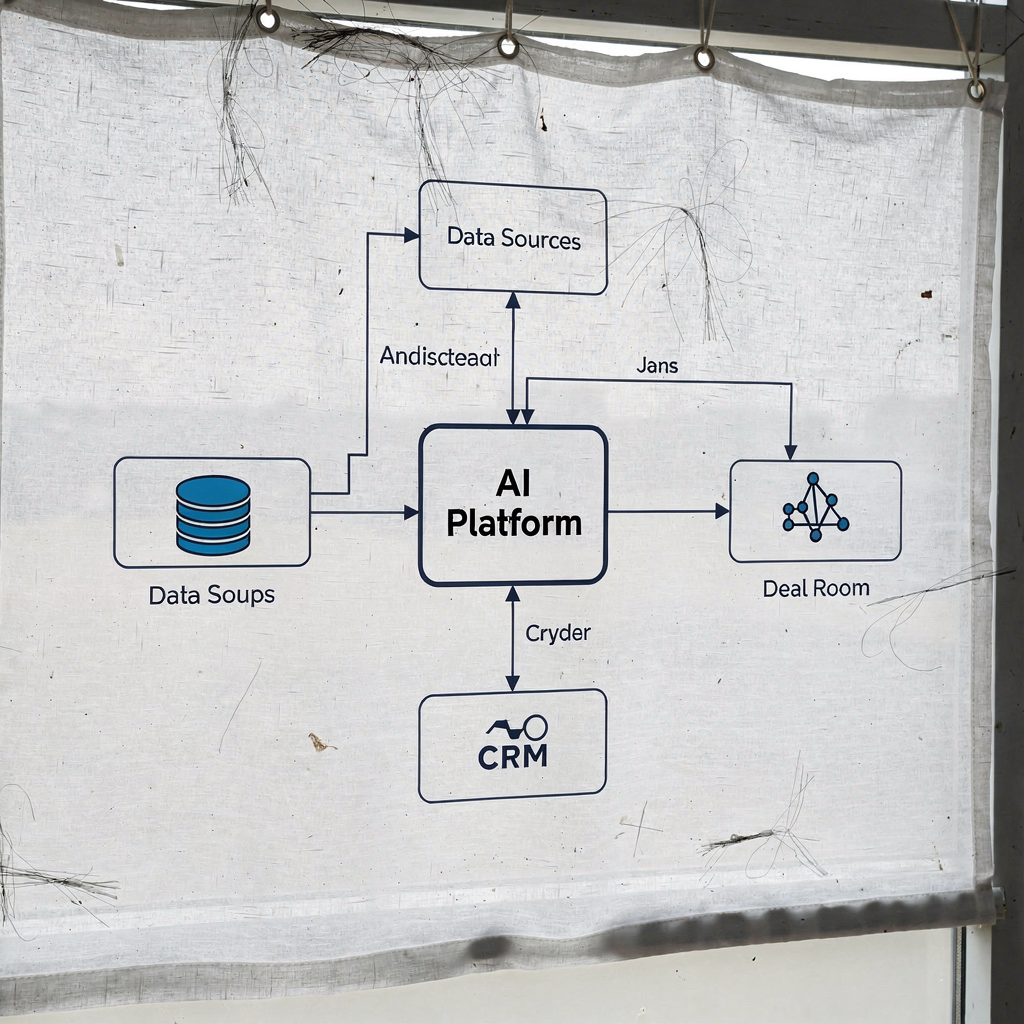

When you implement these capabilities, connect outputs to the deal room and to your CRM so that actions flow seamlessly. For firms that handle many inbound operational messages, tools like virtualworkforce.ai show how an AI assistant can automates the full email lifecycle and push structured data back into systems (automated correspondence case study). That pattern — extract, tag, notify, escalate — is the same one used for lease review. With this stack, teams can underwrite and close with confidence while keeping audit trails and meeting governance expectations.

Drowning in emails? Here’s your way out

Save hours every day as AI Agents label and draft emails directly in Outlook or Gmail, giving your team more time to focus on high-value work.

ai tools for real estate deal sourcing: predictive analytics, lead generation and CRM integration

Deal sourcing is more efficient when teams apply predictive models to property records and tenant signals. Use AI to score properties by probability of sale, distress indicators, or near‑term lease expirations. Data sources include property records, transaction feeds, tenant data, demographic indicators and macroeconomic signals. Those inputs feed predictive analytics that point investment teams toward off‑market opportunities.

Integrate these signals into a CRM so that scored leads move into your pipeline and trigger outreach sequences. For example, push high‑probability assets into DealCloud or Salesforce and start an automated cadence. A well‑designed workflow will flag high‑value leads, assign owners and generate templated outreach drafts. This process boosts lead generation and improves conversion metrics.

KPIs to monitor include lead conversion rate, deals sourced per month and pipeline value uplift. Track time from lead identification to first contact. Also measure the quality of leads by hit rate on submitted offers and by realized IRR. These metrics show whether the AI tool that helps sourcing actually increases deal flow and raises return on effort.

Apply hybrid approaches: combine model scores with human overlays based on local market knowledge. That balance reduces false positives and prevents overreliance on models. If your firm wants examples of operational automation across email and CRM flows, review practical guides on how to scale logistics operations with AI agents for inspiration (how to scale with AI agents). By pairing predictive scoring with CRM integration, teams can source more deals while keeping governance and human judgement central.

agentic ai and generative ai in CRE workflows: from analysis to action

Agentic AI ties analysis to action by running task‑oriented agents that can underwrite, draft memos and schedule site visits. An agentic AI instance can be configured to run an underwriting script, pull comps, generate a pro forma and then create a calendar invite for a site visit. That flow moves work from insight to execution without manual triage at each step.

Generative AI complements that capability by producing memos, market briefs and tenant communications. For example, a generative AI model can draft a market brief summarising vacancy, rental trends and competitor moves. Use templates and prompt libraries so that outputs meet investment criteria and compliance needs. Keep a human in the loop to review recommendations and to approve outbound communications.

Controls matter. Use prompt templates, audit trails and versioning. Require human sign‑off at critical decision points. Provide explainability for investment committees so they can see model inputs and assumptions. That level of traceability helps the committee accept AI-produced memos and pro formas.

Agentic systems and generative AI reduce repetitive steps and free analysts for higher‑value judgement. They also enable scaling: a single analyst can supervise multiple agent flows across multiple markets. For CRE teams focused on portfolio management, this automation reduces friction and accelerates the investment lifecycle. If you want to see how an AI assistant reduces cycle time in operational email workstreams, virtualworkforce.ai demonstrates end‑to‑end automation and governance that fits into existing systems (virtual assistant case study).

Drowning in emails? Here’s your way out

Save hours every day as AI Agents label and draft emails directly in Outlook or Gmail, giving your team more time to focus on high-value work.

implementing ai platform and analytics: build vs buy, data strategy and change management

Choosing whether to build or buy an AI platform is a strategic decision. Off‑the‑shelf platforms like Cherre, Reonomy and Skyline provide fast time to value. Custom models on AWS, GCP or Azure give control and bespoke performance. Your choice depends on data scale, model explainability needs and vendor SLAs. Start with a data audit and standardise schemas before you experiment.

Data priorities include cleaning, labelling and creating reliable pipelines. Perform a gap analysis to identify missing feeds such as leases, rent roll details, tax records and tenant financials. Then map those sources into a single schema that your AI platform can consume. This upfront work reduces model drift and boosts long‑term ROI.

Run a pilot: pick one high‑impact use case, limit scope to 60–90 days and measure business metrics like hours saved and time to close. Use that pilot to test platforms and tools and to build confidence among stakeholders. Train staff and set governance for model updates and monitoring. Also define security controls and explainability requirements for approval committees.

Change management matters. Educate investment teams and property management staff on how to apply AI in CRE workflows. Set up vendor SLAs and a governance board to review outputs and to approve model changes. For teams looking to quantify ROI on automation and analytics, consider measuring saved analyst hours, revenue uplift from better deals and avoided losses from improved risk identification. When you move from pilot to scale, make sure AI outputs feed into your CRM and accounting platforms so the benefits compound across the business.

ai in real estate: governance, risks and measuring ROI for CRE investment firms

Governance must be part of any AI rollout. Address data privacy, model bias and regulatory compliance up front. Keep audit trails and require explainability for investment committees. That makes it possible to defend decisions and to meet fiduciary duties. Also guard against operational risks such as overreliance on models and vendor lock‑in; mitigate these with hybrid human+AI workflows and redundancy in data feeds.

Measure ROI across several dimensions. Quantify cost savings by counting hours saved per analyst. Measure revenue lift from better deals and track speed by time to close. Also estimate risk reduction by comparing avoided losses on past problem deals. A practical ROI framework ties each metric to a dollar value and to a cadence for review.

Start with priority KPIs and a 90‑day pilot plan. Short pilots prove concepts and let you test implementing ai safely. Pick vendors or internal teams and define SLAs that include model explainability, uptime and data security. For firms that manage operational email workflows and data‑dependent correspondence, virtualworkforce.ai shows how automation can cut handling time and increase consistency while retaining full governance (ROI and case examples).

AI is reshaping real estate and creates new opportunities for firms that plan carefully. Use clear guardrails, measure impact, and scale what works. With the right governance, the real estate industry can benefit from improved investment analysis, streamlined operations and stronger portfolio performance.

FAQ

What is an AI agent in commercial real estate?

An AI agent is a software process that performs specific tasks such as underwriting, document review or lead scoring. It uses models and data feeds to act autonomously but often requires human oversight for final decisions.

How can AI speed up underwriting?

AI automates data ingestion, comparables checks and cap‑rate adjustments, producing a valuation model faster than manual work. That shortens time per deal and increases consistency across analysts.

Are AI tools for real estate safe for investment committees?

Yes when they include provenance logging, explainability and human review thresholds. Committees should require audit trails and governance before accepting model outputs.

What does a document processing pipeline include?

A typical pipeline uses OCR to convert scans to text, NER to tag clauses and RAG to answer questions against sources. The outputs feed into diligence reports and the deal room.

How do you measure ROI from AI pilots?

Measure hours saved, revenue uplift from better deals, time to close and loss avoidance. Convert those metrics into dollar values and track them over the pilot duration.

Should CRE firms build or buy AI platforms?

It depends on data scale and control needs. Buy off‑the‑shelf platforms for speed, and build custom models if you need unique performance or deep integration with internal systems.

What is the role of generative AI in CRE?

Generative AI drafts memos, pro formas and tenant communications and accelerates reporting. It should be used with templates and review gates to ensure compliance and accuracy.

How do AI agents handle lease abstraction?

Agents extract key terms from lease documents, tag renewal options, and highlight unusual covenants. They provide structured outputs and links back to source paragraphs for reviewer verification.

Is CRM integration important for deal sourcing?

Yes. Pushing scored leads into CRM triggers outreach and tracking, which turns predictive analytics into measurable pipeline value. Integration ensures follow up and accountability.

What are first steps for implementing AI at a CRE firm?

Run a data audit, pick one high‑impact use case and run a time‑boxed pilot. Define KPIs up front, set governance, and measure outcomes before scaling. Also consider platforms and tools that fit your operational needs.

Ready to revolutionize your workplace?

Achieve more with your existing team with Virtual Workforce.