Why ai matters: faster data, fewer errors in appraisal workflows

AI is reshaping how appraisers collect and check property data. First, it shortens routine steps that used to take hours. Next, it reduces manual errors that creep into the appraisal process. For example, many commercial real estate firms have started pilots: about 92% report pilots or planned initiatives in 2025, while only roughly 5% have fully scaled programmes source. That gap shows how promising AI is, and how hard AI implementation can be.

Automated data aggregation saves time. AI can pull recent sales, public records and listing feeds. Then it can normalise fields, flag mismatches and surface likely comparables. This helps the appraiser focus on judgment rather than clerical work. As a result, the workflow moves faster, with fewer transcription errors and lower rework. In pilots, teams report shorter cycle times on routine reports and more time for inspection and analysis source. Thus, the benefits of AI include efficiency and accuracy.

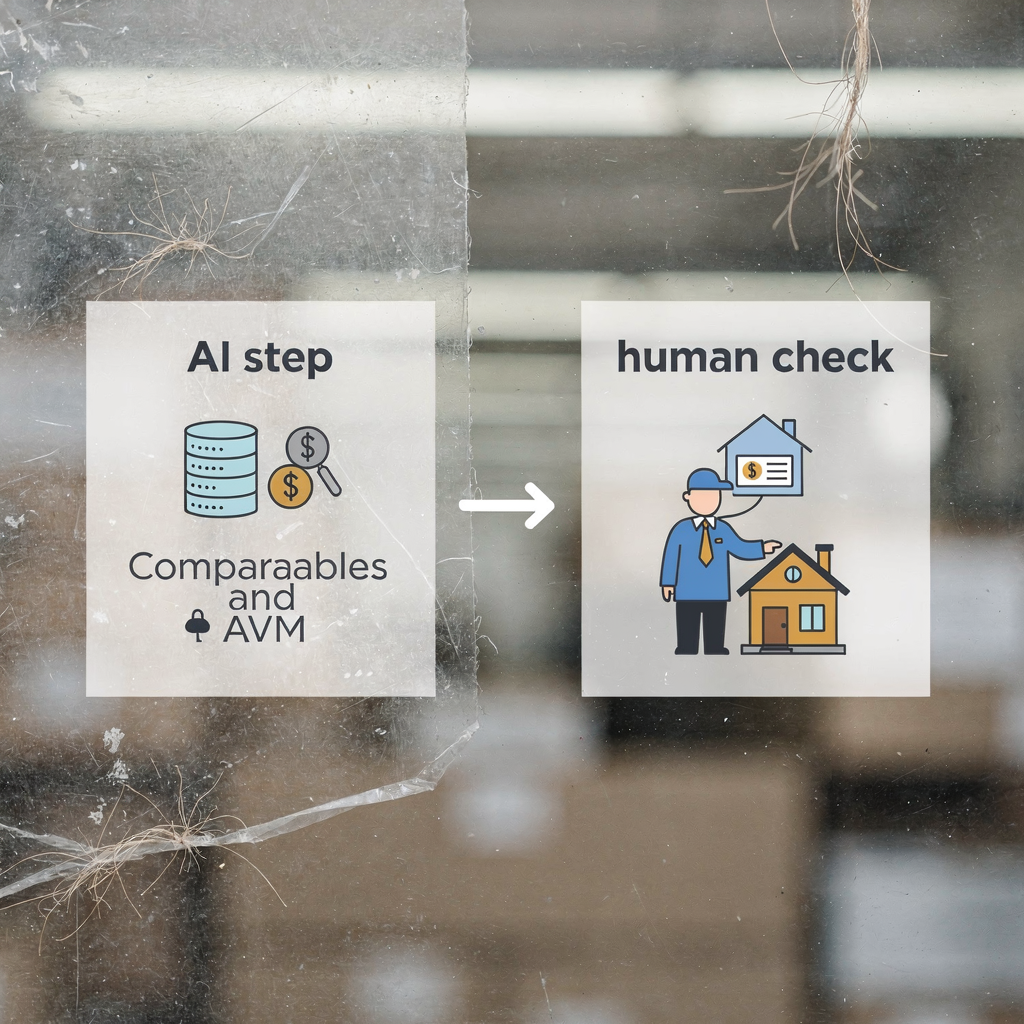

Use-case: automated comparable selection plus an initial AVM estimate before a site check. For homogeneous stock, automated valuation models perform well at producing a baseline value. AVMs work best where comparables are plentiful and the property characteristics are standard. Yet an AVM alone will struggle with unique properties or gaps in public records. Therefore, a hybrid approach is wiser: AI step → human check. This simple process diagram shows the clear handoff:

AI step → human check

AI handles data pull, deduplication, preliminary comparables and anomaly flags. The human appraiser confirms condition, local quirks and legal matters. This partnership between AI and the human appraiser preserves professional judgment while it helps streamline tasks. The role of AI is to reduce repetitive tasks and to flag exceptions for review. For teams wanting to automate operational email and document flows linked to valuation, see how AI agents can automate the full lifecycle of emails to speed approvals and record keeping learn more.

What ai could do for the real estate appraiser: routine to predictive tasks

AI could change the split between routine chores and judgment work. First, AI can handle data collection and cleansing. Second, it can run image recognition on photos to identify roof type, visible damage and basic finishes. Third, AI can spot neighbourhood shifts from new infrastructure or employment trends. Finally, it can run scenario forecasts and sensitivity testing to stress value estimates for different market moves.

Practical mapping: here are six tasks AI can take on for an appraiser. 1) Data pull and normalisation from public records and listings. 2) Photo analysis via image recognition to tag features and apparent condition. 3) Neighbourhood trend detection using amounts of market data and demographic feeds. 4) AVM baseline production as a fast comparator for typical homes. 5) Sensitivity testing and scenario forecasting to show upside or downside ranges. 6) Fraud detection and anomaly scoring to flag suspect transactions. These steps free appraisers from repetitive tasks and leave time for nuanced review.

Three tasks that must remain for the appraiser are clear. First, assessing property condition that is not visible in images. Second, judging unique features that change marketability. Third, legal and title context checks that need local knowledge and human judgment. The partnership between agentic AI outputs and seasoned appraisers strengthens the valuation process without replacing appraiser roles.

Checklist for appraisers adopting tools for appraisers:

- Confirm data provenance and source coverage.

- Validate AVM baselines against recent sales.

- Use photo analysis only as a supplement to site visits.

- Document model limitations in each appraisal report.

- Train staff on human judgment triggers and escalation rules.

- Keep audit logs for each automated decision.

Note that 39% of prospective buyers used AI tools during property search in 2025, so market signals now include AI-driven listings and recommendations source. Appraisers should explore how AI affects comparable selection and buyer behaviour. If you want a practical example of automating operational email around valuation tasks, read about end-to-end email automation that routes, drafts and logs replies for ops teams see example.

Drowning in emails? Here’s your way out

Save hours every day as AI Agents label and draft emails directly in Outlook or Gmail, giving your team more time to focus on high-value work.

Where algorithms and AVMs help the appraiser with property appraisal

Algorithms and AVMs bring clear strengths to real estate valuation. For many standard suburban homes with plenty of comparables, modern AVMs can deliver estimates within ±5% of market price. That accuracy holds when data is fresh and homogeneous. However, AVMs fail when records miss condition or when markets move fast. Common failure modes include unique properties, non-standard floor plans and homes with recent renovations absent from public records.

How to test an AVM or algorithm. Use MdAPE and hit‑rate checks on recent closed sales. MdAPE measures median absolute percentage error. Hit‑rate shows how often the AVM sits within a tolerance band. Also run back‑tests by month to check sensitivity to rapid price swings. Compare AVM distributions against appraiser comps to see if the model is biased in certain neighbourhoods.

Hybrid workflow recommendation. Start with an AVM baseline, then apply human validation. The human should check unusual comparables, inspect property condition and adjust for unique characteristics. That approach reduces time on routine valuations and increases focus where the appraisal process needs it most.

Example: typical suburban home. An AVM uses multiple sales nearby and recent listings to produce a baseline. The appraiser visits, confirms condition and adjusts for a finished basement and driveway slope. The final value estimate blends the AVM baseline with the appraiser’s inspection.

Example: atypical property. A converted church or custom architect home will usually confuse an automated approach. AVMs lack the context to value rare property characteristics. In those cases, appraisers bring market nuance, client interviews and negotiation history to the task. Tools such as HouseCanary and other AVM providers can help for standard stock, but a human appraiser remains essential for unusual assets source.

How ai-powered tools support valuation accuracy in real estate appraisal

AI-powered analytics expand the signals available for valuation. For instance, models can blend demographics, planned infrastructure and local labour markets to forecast short-term shifts in property value. AI can analyse historical data and identify subtle correlations that humans miss. As a result, appraisers get richer context for their professional judgments. This helps them make more informed decisions and to explain value moves clearly.

Explainability matters. Regulators and standards bodies increasingly expect transparency about how models reach outputs. Appraisers should insist on feature importance charts, counterfactual examples and clear data provenance. Those explainability features let an appraiser show why an AI baseline moved up or down. They also support audit trails for review and compliance with appraisal standards.

Two short examples of explainable outputs an appraiser can use in a valuation report: First, a feature importance table that ranks drivers such as recent sales, school ratings and transport links, and shows the percentage influence on the AI baseline. Second, a counterfactual scenario that shows how the AVM baseline would change if a nearby infrastructure project were delayed. Both outputs clarify model thinking and help the appraiser defend adjustments.

Modern AI systems often combine machine learning with rule‑based checks. That mix yields fast pattern detection while retaining guardrails. When using AI technology, demand traceability of public records and listing feeds. Also ask for retraining cadences and documentation of model drift. As one expert put it, “The rise of AI in real estate valuation does not replace the professional appraiser but rather strengthens their ability to make informed decisions” source. For teams that must automate large volumes of email around valuations or approvals, virtualworkforce.ai shows how AI agents can reduce handling time and keep full context in shared inboxes learn more.

Drowning in emails? Here’s your way out

Save hours every day as AI Agents label and draft emails directly in Outlook or Gmail, giving your team more time to focus on high-value work.

Integrating ai and appraisers: human judgement, explainability and workflow

Integration must preserve professional judgment and auditability. A pragmatic model begins with pilots. Then it moves to validation, governance and training before scaled rollout. First, pilot a focused use-case such as pre‑inspection comparables. Next, validate with historical back‑tests and independent review. Then set governance, roles and data controls. Finally, train staff and scale where metrics meet targets.

Four-step integration plan:

- Pilot a single, measurable use-case and collect KPIs.

- Validation and governance: set data access, audit trails and appraisal standards for automated steps.

- Staff training on tool use, exceptions and human judgment triggers.

- Scaled rollout with monitoring, vendor audits and change control.

Roles and controls. Assign a governance lead, technical owner and a subject matter group of seasoned appraisers. Maintain logs of ai outputs and who accepted or overrode them. Use an AI RMF and include trustworthy AI principles such as fairness, explainability and provenance. Ensure the model can be paused and audited. Do not assume AI will replace human oversight; appraisers bring local market knowledge and context that models cannot replicate. The partnership between AI and appraisers should augment, not replace human decision making.

Practical governance checklist for firms:

- Define pilot scope and KPIs.

- Map data flows and log provenance.

- Document appraisal and valuation overrides.

- Set vendor SLAs and audit windows.

- Train staff on model limits and escalation paths.

- Review regulatory alignment and appraisal standards.

Finally, be realistic about AI adoption. Many pilots stall during scale due to data standardisation and explainability gaps. To succeed, incorporate AI into appraisal workflows slowly, keep audit trails and involve professional appraisers in governance. That way the future of real estate includes a real partnership between AI systems and human expertise rather than replacing appraisers or eroding professional judgment.

Best practices for appraiser adoption: data, testing and regulation

Adopt a set of practical steps that support safe, effective use. First, inventory data sources and log provenance. Second, run bias and accuracy tests before production. Third, make client disclosure part of the report when AI contributes materially. Standards and reporting guidance from international bodies increase pressure for transparency. For a compact list, follow these ten best practices below.

Ten best practices

- Maintain a comprehensive data inventory and access map.

- Log provenance for each data point used in a valuation.

- Run bias tests and fairness checks on model outputs.

- Request explainability: feature importance and counterfactuals.

- Define pilot KPIs and back‑test against historical sales.

- Disclose AI contributions in the appraisal report to clients.

- Provide staff training and role‑based access to models.

- Require vendor audits and documented model change logs.

- Conduct a regulatory review for local appraisal standards.

- Set up continuous monitoring and drift detection in production.

Starter one‑page printable checklist for day‑to‑day use:

– Check data provenance for new comps. – Confirm AVM baseline and model date. – Verify photo tags against site notes. – Note any model overrides and rationale. – Save audit trail and client disclosure text.

Risk management matters. Ensure models are validated and that there is a named owner for each tool. Balance the benefits of AI against the need for transparency and client trust. Real estate professionals must combine analytics with professional judgment. Doing so protects clients and improves the work of appraisers. For teams that rely on operational email and document flows, automated email agents can reduce time lost on triage while keeping records that support audits and regulatory queries see how.

FAQ

What is the role of AI in modern real estate appraisal?

AI supports data aggregation, initial AVM baselines and pattern detection. It boosts efficiency and helps appraisers focus on judgment and contextual understanding.

Can AI replace a human appraiser?

No. AI can handle repetitive tasks and some analytics but it cannot replace appraisers who make legal, contextual and condition judgments. Professional appraisers remain central to quality valuation.

How accurate are AVMs compared with appraiser valuation?

AVMs can be within a small tolerance for standard properties, often around a ±5% band in stable markets. For unique properties, an appraiser’s inspection and local knowledge are essential.

What tasks should I let AI handle?

Let AI handle data pull, cleansing, photo tagging, trend detection and baseline AVMs. Keep inspections, unique feature adjustments and legal checks for humans.

How do I check an AI model before use?

Run back‑tests, check MdAPE and hit‑rate metrics, test for bias and review feature importance. Also check data freshness and public records coverage.

What explainability should I request from vendors?

Ask for feature importance, counterfactual scenarios and data provenance logs. These items help you explain ai outputs in an appraisal report and to clients or regulators.

Are there standards for using AI in valuation?

Yes. Appraisal standards and emerging guidance from international bodies emphasize transparency and governance. Firms should map their policies to these standards and record decisions.

How do I keep audit trails when using AI?

Log each AI output, note who accepted or overrode recommendations and store the data sources used. This practice supports traceability and future reviews.

Will adopting AI save time in the appraisal process?

Yes. AI can shorten time spent on repetitive tasks and data collection, allowing appraisers to spend more time on analysis and client advice. Time savings also reduce errors and rework.

Where can I learn more about automating operational emails tied to valuations?

For firms that need to automate approvals, routing and record keeping around valuations, look at solutions that automate the full email lifecycle. They cut handling time and keep context for audits and team coordination read more.

Ready to revolutionize your workplace?

Achieve more with your existing team with Virtual Workforce.