AI tools for commercial real estate investment

How ai is reshaping the real estate market and commercial real estate: the power of ai

AI is reshaping real estate by changing how professionals price, source and manage portfolios. First, large models and machine learning let teams process thousands of data points quickly. Next, natural language processing helps summarise leases and extract clauses. As a result, investment teams get faster signals and clearer valuation inputs for asset selection and portfolio management. This shift affects pricing, sourcing and portfolio strategy across the sector.

Core facts matter. For example, 92% of commercial real estate firms have started or plan to pilot AI initiatives, while only about 5% have fully scaled programmes. Also, McKinsey estimates that generative AI could add between US$110 billion and US$180 billion in value to real estate. These numbers show both the potential and the execution gap.

Who wins and who loses? Winners will be firms that adopt data-driven sourcing and extend analytics into asset and portfolio management. On the other hand, legacy operators that ignore analytics risk losing yield and mispricing risk. For example, real estate investors that build machine learning models for market analysis and valuation gain a sustained edge. Meanwhile, smaller operators may struggle because data management and talent are scarce.

Regulatory and privacy issues also shape outcomes. For instance, EU data rules influence how firms use tenant information. Therefore, governance and audit trails matter. Firms must combine technical controls with clear policies. Finally, AI is transforming underwriting and due diligence, and AI is reshaping real estate practice at speed.

Drowning in emails? Here’s your way out

Save hours every day as AI Agents label and draft emails directly in Outlook or Gmail, giving your team more time to focus on high-value work.

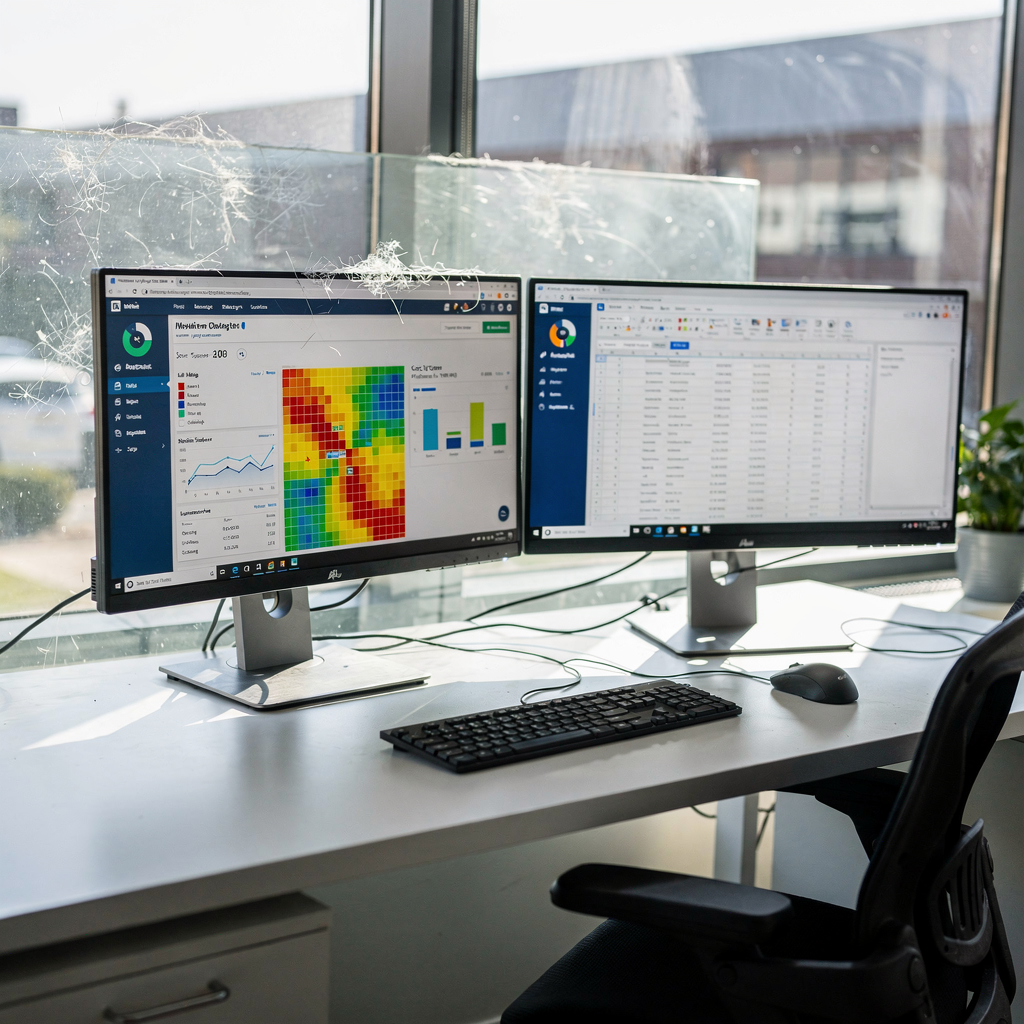

Key ai tool and ai capabilities in ai in real estate: which platforms matter

This chapter maps the main platform types. First, property-level analytics platforms provide comps, rent roll parsing and valuation estimates. Second, data-integration platforms connect public records, broker feeds and internal systems. Third, leasing platforms automate deal tracking and tenant engagement. Fourth, underwriting automation replaces long spreadsheet processes with model-driven outputs. Together, these ai capabilities support site selection and financial analysis.

Notable examples include Skyline AI for asset selection, VTS for leasing workflows, and Enodo for underwriting and model standardisation. Also, Cherre, Reonomy and HouseCanary supply data and valuations. These names show tools tailored to different stages of the deal lifecycle. For instance, Skyline AI uses ML to suggest investment opportunities. VTS helps leasing teams streamline tenant conversations and lease tracking. Enodo cuts model build time by automating inputs and outputs.

Typical capability layers look like this: data sources and ingestion, machine learning or machine learning models, model serving and APIs, plus a UI for analysts. Accuracy and time savings vary. Underwriting that once took weeks can fall to minutes in some workflows. In practice, firms report large time savings and improved valuation confidence when they combine AI platform outputs with human review.

Vendors also differ on integration and hosting. Some run in a cloud or dedicated data centre. Others provide APIs for direct queries. Choosing an AI platform depends on the data foundation and the appetite for vendor vs build. If you need to automate operational emails and tie them to ERP data, see how virtualworkforce.ai automates the full email lifecycle and integrates with business systems for secure routing and replies (automated logistics correspondence).

Generative ai and agentic ai: new ai use cases for underwriting, modelling and design

Generative AI and agentic AI extend capabilities beyond prediction. Generative AI creates synthetic scenarios, summarises documents and drafts deal memos. Agentic AI coordinates tasks across systems. Together, they let teams automate multi-step processes that once required many people.

Practical uses include automatic lease summarisation, model-driven redevelopment scenarios and automated deal memos. For example, a generative AI model can read a lease and extract termination dates, rent escalations and key obligations so an underwriter can focus on exceptions. Also, agentic AI can run a checklist: pull the rent roll, validate tenant credit, and draft an acquisition memo for approval. These agents can escalate only when rules trigger a manual review.

However, limits exist. Hallucination is a core risk with generative AI. Therefore, firms need grounding data and audit trails. For that reason, governance matters. Below is a short governance checklist you can apply to generative and agentic AI.

Governance checklist for generative/agentic AI:

– Define permitted tasks and scope. Next, map sensitive data flows and ensure compliance.

– Require data grounding and citeable sources for every generated fact.

– Log all agent actions and create a retrievable audit trail.

– Set human-in-the-loop controls for decisions that change cash flow or valuation.

– Run adversarial tests and measure error rates and drift.

Finally, genAI provides speed and scale. Still, you must manage risk and embed controls. For concrete examples of automation that reduces handling time, see how a rental platform cut lease processing times by integrating AI (Inoxoft report).

Drowning in emails? Here’s your way out

Save hours every day as AI Agents label and draft emails directly in Outlook or Gmail, giving your team more time to focus on high-value work.

How AI forecast tools project real estate demand and forecast market cycles

AI forecast tools combine transaction history, demographics, amenities and macro indicators to predict rent, vacancy and real estate demand. Machine learning models detect nonlinear patterns across markets. As a result, they can extend sightlines beyond traditional comparables. For asset managers this improves timing and positioning.

Model inputs often include past transactions, permit filings, population growth, labour statistics, and nearby amenity data. Third-party feeders add broker listings and proprietary cash flow histories. Data quality matters. Therefore, teams must normalise and validate inputs before training machine learning models. They should also tune models for seasonality and local idiosyncrasies.

When to trust a forecast? First, check out-of-sample validation and backtests. Second, inspect prediction intervals. Third, compare model outputs to simple benchmarks, such as rolling averages. Typical error ranges vary by horizon. Short-term forecasts often show lower errors, while multi-year cycles carry more uncertainty. In practice, AI forecasts complement human judgement rather than replace it.

For asset and portfolio management, forecasts feed scenario plans and stress tests. They help underwrite acquisitions and set rent-roll strategies. Also, forecasts can identify emerging real estate opportunity pockets in suburban and multifamily segments. However, validate assumptions and run sensitivity checks on cap rate and cash flow inputs.

One more point: AI adoption in forecasting still faces hurdles. Data gaps, model drift and governance are common. Yet, firms that embed rigorous validation and continuous monitoring see better outcomes and new insights.

Ways AI can accelerate operations and lift efficiency: practical ai use for asset managers

AI lifts efficiency in operations by automating repetitive tasks and surfacing exceptions. For asset managers, common wins include lease processing, maintenance scheduling and tenant communications. For instance, AI can parse a rent roll, flag missing clauses and feed corrected entries into an asset management system. This reduces error and speeds up closings.

Evidence supports investment. Implementations report productivity improvements between 26% and 55%. Also, some deployments return about US$3.70 for every US$1 spent. These metrics make it easier to justify automation investment.

Quick-win workflows include automated lease abstraction, tenant inquiry triage and preventative maintenance scheduling. You can also automate rent collection reminders and escalate late payments automatically. If your ops team handles lots of transactional email, a specialised agent can reduce handling time by routing and drafting replies. For logistics-related email automation that parallels these needs, see a practical example of end-to-end email automation that links to ERP and other systems (AI in freight logistics communication).

Adoption requires change management. Train staff on new tools and run pilots on a subset of assets. Track key metrics such as time saved, accuracy of abstractions and tenant satisfaction. Also, decide between vendor solutions and in-house builds based on integration needs and data maturity. If your firm handles cross-system emails and shared inboxes, virtualworkforce.ai demonstrates how to automate the full lifecycle of operational email and reclaim staff time (how to scale logistics operations with AI agents).

Finally, remember this: automation should free teams to focus on higher-value decisions. When implemented well, AI-powered tools streamline workflows and deliver measurable productivity and tenant service improvements.

From pilot to scale: implementing AI in commercial real estate with measurable ROI

Scaling AI requires a pragmatic plan. First, build a data foundation. Clean rent rolls, lease files and transaction feeds. Next, choose models and validate them. Then, integrate outputs into existing underwriting and asset management systems. Finally, train teams and monitor outcomes.

Steps and checklist:

– Data foundation: centralise data sources and set access controls.

– Model validation: run backtests and compare to human benchmarks.

– Integration: connect APIs and ensure audit logs for every decision.

– Staff training: teach users how to interpret model outputs and exceptions.

– Vendor SLAs and KPIs: measure return, error rate and time saved.

Common barriers include data quality, legacy systems and scarce talent. To mitigate these, start with narrow pilots that target a clear workflow. For example, automate lease abstraction on 10 assets, measure time saved and error reduction, then expand. Also, consider hybrid models that combine vendor platforms with in-house experts. A staged rollout improves governance and reduces disruption.

Track a small set of KPIs to show value. For instance, measure underwriting cycle time, forecast error against realised rents and tenant response times. Use a benchmark to know when to scale. When firms do this well they move from pilot status to scaled programmes and start to capture the economic upside that analysts predict. In fact, ai adoption remains uneven, but firms that tie projects to measurable metrics tend to succeed.

For teams focused on operational email bottlenecks, consider systems that automate routing, resolution and replies and that ground drafts in ERP and document stores. That approach gives immediate ROI and improves consistency. See a vendor case for end-to-end email automation and how it reduced handling time per message (virtual assistant logistics).

FAQ

What are the best AI tools to streamline underwriting?

Top tools include platforms that combine data ingestion, valuation models and automated reporting. For example, Enodo automates parts of underwriting and Skyline AI supports asset selection.

How accurate are AI forecasts for rents and vacancies?

Accuracy depends on inputs and horizon. Short-term forecasts tend to be more accurate than long-term cycle projections, and validation against out-of-sample data is essential.

Can AI automate lease abstraction completely?

AI can automate most lease abstraction but human review remains necessary for unusual clauses. Use AI to extract standard fields and flag exceptions for manual review.

What governance is needed for generative AI in real estate?

Require data grounding, audit trails and human-in-the-loop checks for material decisions. Also, log agent actions and limit use on sensitive data.

How do I choose between building vs buying an AI platform?

Choose based on data maturity, integration needs and time to value. Vendors accelerate deployment; in-house builds give custom control but need talent and maintenance.

What efficiency gains can asset managers expect?

Deployments report productivity improvements between 26% and 55%, with ROI examples around US$3.70 per US$1 spent in some cases. Results vary by workflow and scale.

Are there examples of AI improving leasing workflows?

Yes. VTS is a leading leasing workflow platform that helps teams manage pipeline and tenant interactions more efficiently. Many teams report faster deal cycles.

How do AI agents interact with existing systems?

Agents typically use APIs and connectors to pull ERP, document stores and property management records. They then produce structured outputs and human-review prompts.

Will AI replace real estate analysts?

AI will augment analysts by taking over repetitive tasks and surfacing insights. Analysts remain essential for judgement, negotiation and strategy.

How do I start a pilot that can scale?

Begin with a focused use case, define KPIs, secure data access and pick a vendor or small internal team. Measure time saved and accuracy, then expand based on results and governance.

Ready to revolutionize your workplace?

Achieve more with your existing team with Virtual Workforce.