accounts payable and business central: why ap automation is essential for microsoft dynamics 365 business central

First, AP teams still face high volumes of paper and PDF invoices. Next, manual AP processes cost time and cause errors. For example, many teams still copy data from supplier emails into the ledger. Also, this creates slow approvals and limited cash visibility. Therefore, businesses running business central look for ways to automate. In fact, 41% of UK-based AP teams are actively moving towards full AP automation, while 17% expect to reach full automation within 6 to 12 monthssource. These statistics show demand. They also show momentum.

First, what is at stake? Manual AP processes create late payments and missed discounts. Next, they increase risk of duplicate payments and fraud. Also, they hide liabilities from management. Therefore, automating AP is not a luxury. It is core to modern finance. Business Central ERP customers can benefit greatly. The core benefits include up to a 70% reduction in invoice processing time and roughly 60% lower cost per invoice when AP automation is implementedsource. These efficiency gains improve the general ledger and free time for strategic work.

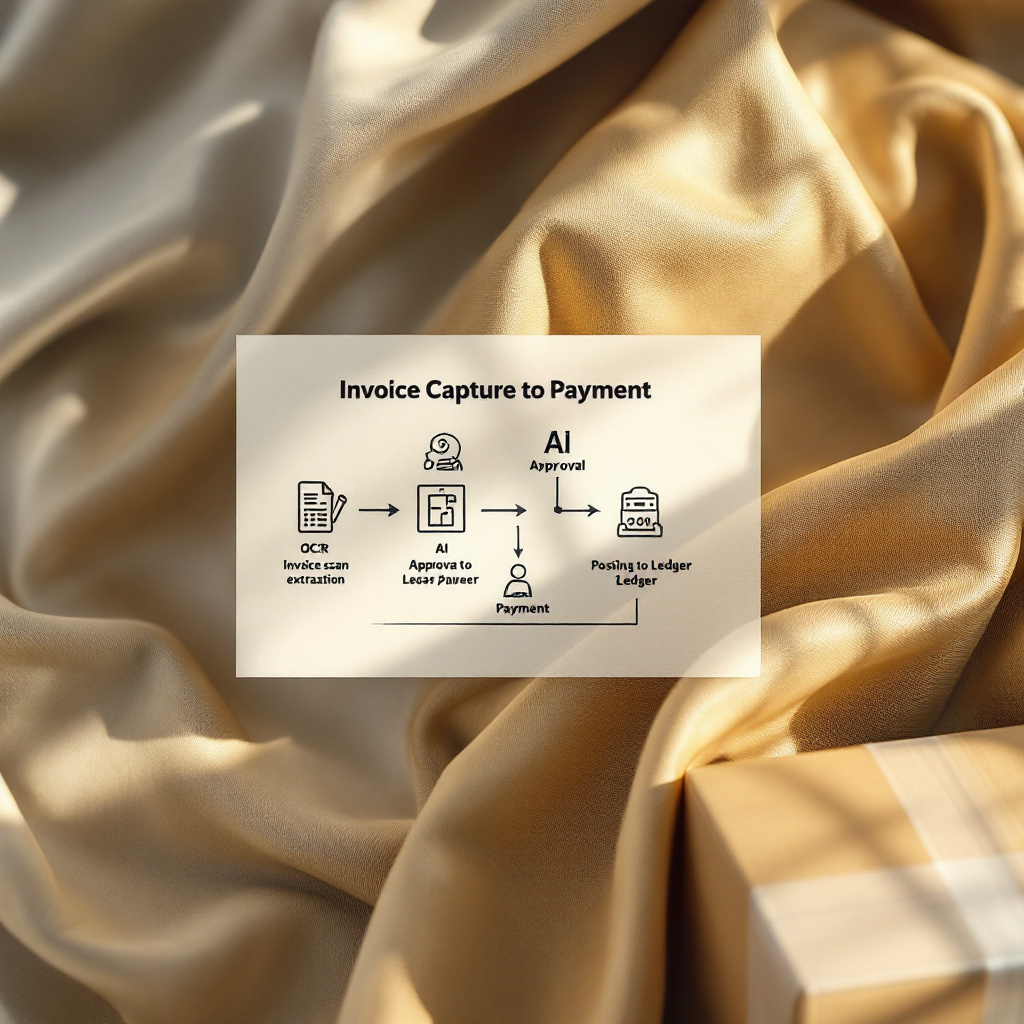

First, a working definition helps. AP automation covers invoice capture, approval workflows, payment execution, and an audit trail. Next, an effective approach includes capture of purchase invoice data, validation against purchase order or PO, and posting into the ledger. Also, an end-to-end flow reduces manual data entry and speeds month-end. Therefore, when you automate in business central you get cash visibility, control, and compliance. For teams that need email-driven exceptions or fast replies, integrating with email automation tools can reduce handling time. For example, our company provides no-code AI agents that draft and update replies using ERP data, which helps AP teams respond faster and keep supplier conversations in sync with the system (ERP email automation for logistics).

First, organizations must decide whether to adopt a fully embedded solution or a connector-based path. Then, they should map approval thresholds and segregation of duties. Also, consider whether the chosen path integrates with treasury or other ERPs such as dynamics gp or legacy NAV. Finally, choose a vendor that offers audit trails, pre-built integrations, and proven ROI. This helps you save time and money while transforming AP from a time-consuming back office to a control center.

invoice capture and automated ap: using OCR and AI to automate the invoice process in business central

First, invoice capture is the first step in automating the accounts payable process. Next, optical character recognition or OCR extracts text from PDFs and images. Then, AI validates fields, maps supplier invoice data to the GL, and matches invoices to PO or receipts. For example, intelligent capture can perform 2-way and 3-way PO matching, and flag discrepancies for human review. Also, extraction accuracy improves over time with machine learning. Consequently, exception rates fall and time-to-post shrinks.

First, consider the tech. OCR plus AI handles invoice header data, line-level details, tax, and coding. Next, a robust system validates currency and VAT, then auto-populates invoice coding. Also, the system can import files or accept emailed invoices. Therefore, teams remove the need for manual data entry and reduce errors. For supplier invoice volumes, this means fewer touch points and less rework. For example, Continia offers a document capture product that is fully embedded into business central. Continia document capture captures invoices, validates vendor data, and creates purchase invoice drafts inside business central, reducing time spent on each invoicesource.

First, measure the right things. Key metrics include extraction accuracy, exceptions rate, and time-to-post. Next, track percentage of invoices posted without human touch. Also, monitor early-payment discounts captured and days payable outstanding. Then, use those figures to tune rules and expand automation. For AP departments, reducing exceptions by half can double throughput. As a result, finance teams free capacity for vendor negotiations and cash forecasting. Finally, remember that invoice capture is only the start. To gain maximum value, you must connect capture to workflow, approvals, and payments.

Drowning in emails? Here’s your way out

Save hours every day as AI Agents draft emails directly in Outlook or Gmail, giving your team more time to focus on high-value work.

integration and end-to-end accounts payable: connecting invoice capture, workflow and payments in d365 business central

First, an end-to-end ap automation flow links invoice capture to approvals, posting, and vendor payments. Next, within business central you can route invoices through an approval workflow, post them to the general ledger, and schedule payments. Also, this end-to-end approach ensures that invoice and payment records remain in sync. Therefore, audit trails stay intact and month-end reconciliations become straightforward.

First, consider integration options. You can choose native apps or use connectors. Then, decide if you want a fully embedded approach or a hybrid model. Also, many apps are available on microsoft appsource for quick discovery. For payments and Positive Pay, Mekorma Payment Hub is a common choice; it supports secure vendor payments and integrates with bank formats to reduce fraud risk. For invoice capture, Continia is widely used as a document capture and processing tool that integrates with business central and supports 2-way and 3-way matching. These pre-built integrations reduce implementation time and help maintain data integrity across companies and entitiessource.

First, cross-company and multi-entity scenarios need attention. Next, ensure chart of accounts mappings and intercompany posting rules are defined. Also, confirm that posting groups and tax setup transfer between entities. Then, set approval workflow rules per entity. Additionally, consider how to handle supplier invoice disputes and remittance advice. Finally, use API connectors or pre-built integrations to sync vendor master, purchase order, and payment data. For teams that handle high volumes of email exceptions, adding an AI email agent can speed replies and update invoice status automatically. See our guide on automated logistics correspondence for ideas on reducing email friction across systems (automated logistics correspondence).

ap process automation solutions: choosing the right automation solution for microsoft dynamics 365 business central

First, decide between embedded and third-party connector approaches. Next, evaluate how deeply the solution integrates with business central erp. Also, check whether the software offers OCR and AI capabilities at the line level. Therefore, ask vendors for extraction accuracy figures and exception handling workflows. For an embedded solution, the benefits include tighter sync with posting and fewer integration points. However, third-party connectors may provide more advanced AI or payment features. For example, look for the right automation solution that offers Positive Pay, vendor payments, and scalable processing.

First, compare feature sets. Next, evaluate security, fraud detection, and vendor support. Also, confirm pre-built integrations, import files capability, and whether the product is listed on microsoft appsource. Then, validate whether the solution supports vendor invoice processing end-to-end and whether it integrates with purchase order and receipt matching. For many mid-market customers, Continia and Mekorma Payment Hub are common shortlists because they integrate with Business Central and offer embedded functionality. Also, vendors that provide strong implementation support reduce go-live risk.

First, use a decision checklist. Next, include compatibility with dynamics 365 business central, OCR quality, workflow customisation, scalability, and vendor SLAs. Also, confirm the solution supports cross-company intercompany posting, and that it can import PO and invoice data from external sources. Then, require audit trails and clear segregation of duties. Finally, test with a pilot dataset and validate metrics such as cost per invoice and average time-to-post. If you need faster responses to supplier queries, consider integrating email automation; our AI agents can draft context-aware replies and update invoices using API access to ERP data (virtual assistant logistics).

Drowning in emails? Here’s your way out

Save hours every day as AI Agents draft emails directly in Outlook or Gmail, giving your team more time to focus on high-value work.

implement and automate your accounts payable: roadmap to move from manual ap processes to automated ap

First, map current processes. Next, identify time-consuming steps and exceptions. Also, document approval thresholds and who makes payment decisions. Then, select a pilot set of vendors and invoice types. For example, start with non-PO invoices or recurring purchase invoice patterns. Also, include import of historical invoices to improve AI models. Then, configure invoice capture, set up approval workflow, and test posting to the general ledger. For many teams, a pilot runs six to eight weeks. During that time, collect metrics and fine-tune rules.

First, plan your integration. Next, choose between a fully embedded or connector approach. Also, configure bank file formats and vendor payment profiles for smooth vendor payments. Then, train users on the new approval workflow and change controls. Additionally, set up segregation of duties and audit trails so approvals and payments meet compliance. For supplier onboarding, provide suppliers clear guidance on how to submit invoices to reduce exceptions. If email remains a bottleneck, combine systems with an AI email agent to handle repetitive inquiries and to sync invoice status across inboxes and ERP using API connections. See our guide on scaling logistics operations without hiring for governance tips (how to scale logistics operations without hiring).

First, after go-live, run hypercare and monitor KPIs closely. Next, expand the scope to more vendors and invoice types. Also, update workflows to reflect business changes. Then, add payment automation and Positive Pay to reduce fraud risk. Finally, ensure documentation and continuous training so teams keep improving. Common pitfalls include poor data quality, incomplete supplier onboarding, and underestimating change management. Address these early to save time and money in the long run.

measure impact and scale: KPIs, savings and continuous process automation for microsoft dynamics

First, measure invoice cycle time, cost per invoice, and exception rate. Next, track early-payment discounts captured and days payable outstanding. Also, record percentage of invoices posted without human touch. Then, set targets and review quarterly. For AP departments, realistic goals include a 50–70% reduction in processing time and up to 60% lower cost per invoice, as reported in market studiessource.

First, calculate ROI clearly. Next, use time savings, reduced errors, and fewer late fees as inputs. Also, include staff redeployment value. Then, expand automation to payments and treasury to gain more leverage. For example, integrating Mekorma Payment Hub for vendor payments can add security and lower bank fees while automating positive pay checks. Additionally, extend automation for microsoft dynamics to cover PO matching, invoice coding, and early payment optimization. Finally, scale to purchase-to-pay and connect to other ERPs and erps in your group to consolidate control.

First, continuous improvement matters. Next, run periodic audits of the workflow and capture accuracy. Also, test new AI models and import files to enrich training data. Then, integrate supplier portals and EDI if volumes justify it. Additionally, ensure the solution integrates with your bank and treasury. For teams that handle lots of email exceptions, no-code AI agents can help draft replies, update statuses in the ERP via API, and reduce handling time dramatically. See our piece on AI for freight-forwarder communication for examples of how AI can handle repetitive messages while keeping ERP data current (AI for freight forwarder communication).

FAQ

What is AP automation for Business Central and why does it matter?

AP automation for microsoft dynamics 365 business central automates invoice capture, approval workflow, posting, and payment scheduling inside the ERP. It matters because it reduces manual data entry, cuts processing time, and increases cash visibility.

How does OCR and AI improve invoice processing?

OCR extracts text from PDFs and scans while AI validates fields and maps invoice lines to the chart of accounts. Together they reduce manual data entry and lower exception rates.

Can I use a fully embedded solution inside business central?

Yes. Some vendors provide a fully embedded solution that runs inside business central erp, reducing integration points and preserving audit trails. Continia is one example of embedded document capture that integrates with Business Central.

What payment options integrate with Business Central?

Payment hubs and connectors, like Mekorma Payment Hub, link bank files, Positive Pay, and vendor payments to business central to automate payment runs and reduce fraud risk. These integrations also streamline reconciliation.

What KPIs should finance teams track after automation?

Track invoice cycle time, cost per invoice, exception rate, and days payable outstanding. Also measure early-payment discounts captured and percentage of invoices posted without human touch.

How long does a typical AP automation pilot take?

Pilots commonly run six to eight weeks, including mapping, configuration, and testing. Then teams move to phased rollouts while monitoring KPIs and tuning rules.

Do automation solutions support multi-entity companies?

Yes. Many AP automation tools support cross-company and multi-entity setups by preserving posting rules, tax codes, and intercompany mappings to keep data integrity across entities.

What are common implementation pitfalls?

Pitfalls include poor supplier onboarding, incomplete master data, and underestimating change control requirements. Addressing these early reduces disruptions and speeds ROI.

How can I handle email-driven exceptions more effectively?

Use no-code AI email agents that read email context, pull ERP data via API, and draft replies or update invoice status automatically. This reduces handling time and keeps communications in sync with the system.

Where can I learn more about integrating ERP email automation with AP processes?

Explore resources on ERP email automation and related workflows. For practical guidance on using AI to automate email and ERP tasks, see our ERP email automation guide and case studies on virtualworkforce.ai.

Ready to revolutionize your workplace?

Achieve more with your existing team with Virtual Workforce.