Blog

AI agents for real estate administrators

AI agent for real estate: agentic AI to automate listing, lead generation and showings AI offers real estate administrators new ways to automate the end-to-end listing lifecycle. First, agentic AI can create a listing, qualify a lead, and book a property showing with minimal human input. Next, an ai agent for real estate runs workflows […]

AI for appraisers: Modern real estate appraisal

Why ai matters: faster data, fewer errors in appraisal workflows AI is reshaping how appraisers collect and check property data. First, it shortens routine steps that used to take hours. Next, it reduces manual errors that creep into the appraisal process. For example, many commercial real estate firms have started pilots: about 92% report pilots […]

Email assistant for real estate appraisers

Why an appraiser should adopt an email assistant now First, AI tools are near-universal in real estate; recent surveys report around 97% firm-level engagement with AI tools, and appraisers who wait risk falling behind. For example, industry reporting shows that many professionals already use AI to manage client messages and summary reports, and adoption is […]

AI assistant for real estate appraisers

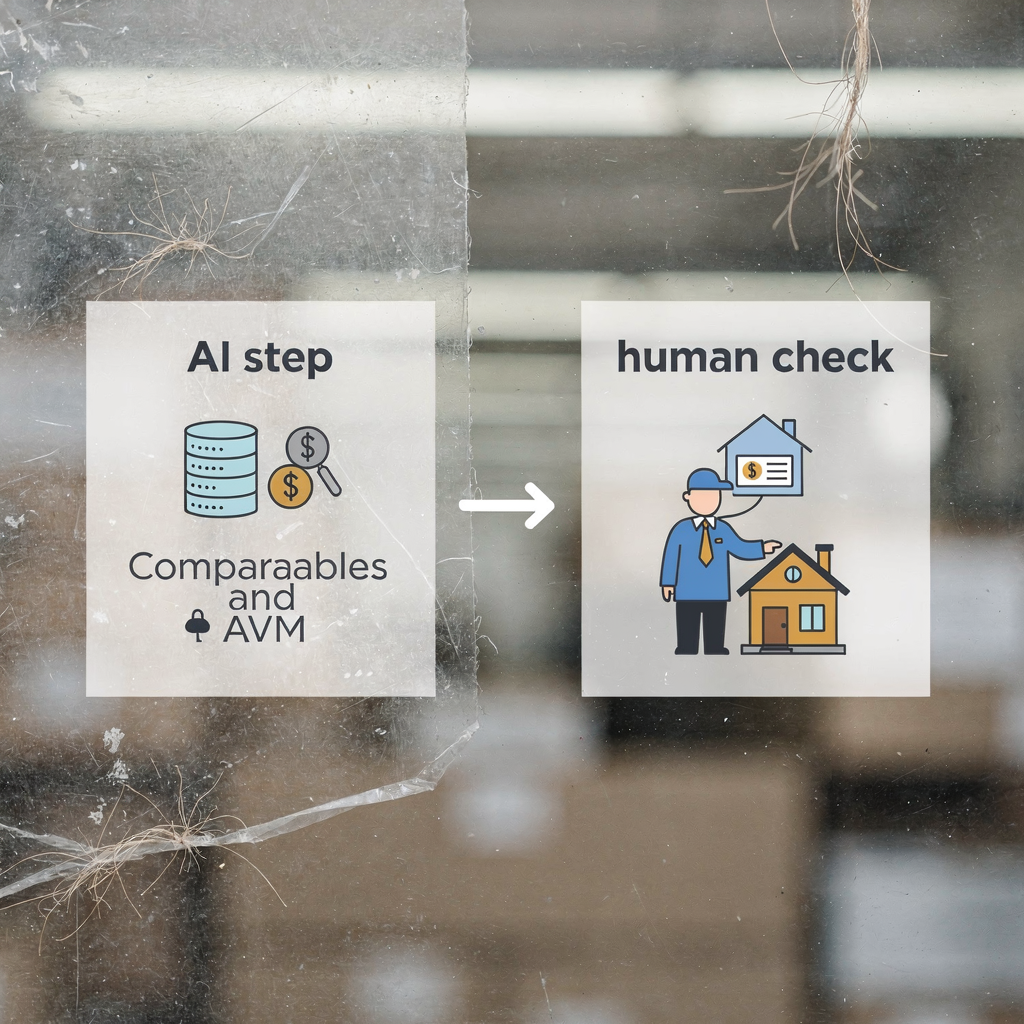

ai assistant: How an appraisal ai streamlines property appraisal workflows for appraiser and real estate agents. An AI assistant can automate routine parts of property appraisal to save time and increase consistency. First, it will gather property data, then it will search for comparable sales and finally it will draft a first-pass report. This sequence […]

AI agents for real estate appraisers – appraisal tools

ai and artificial intelligence: what ai-powered agents do for appraisal AI agents transform how appraisers handle data, and they do it by ingesting many sources. They read sales records, tax rolls, images, listing feeds, and market data to produce automated outputs that support property appraisal. These agents can run AVMs, perform computer vision on photos, […]

AI for mortgage brokers: automation and workflow tools

mortgage: Why ai and ai-powered tools matter to the mortgage broker AI has moved from theory into practical use across the mortgage world. For a mortgage broker, the priority is to reduce processing time and cost while improving conversion. AI shortens origination by speeding data capture, enabling fast credit checks, and triaging leads. For example, […]