AI and financial services: why an AI-powered email assistant matters for financial institutions

AI now shapes how financial institutions handle high volumes of client messages. First, broader AI spend in finance is projected to rise sharply, reflecting more investment in automation and client-facing tools. For example, PwC reports that relationship managers will spend more time creating value when supported by AI assistants that gather real-time data Viitorul bankingului: Cum transformă AI industria – PwC. Also, Bank of America’s virtual assistant Erica has served over 50 million clients, which shows client trust and scale Un deceniu de inovație în AI: Asistentul virtual Erica al BofA depășește …. Next, email remains a primary channel with billions of users worldwide, so automating email workflows reduces volume pressure and improves timeliness and auditability Statistici globale despre email 2025 | Creșterea și date despre email în SUA.

AI reduces repetitive triage and routing. Then, it helps advisors and teams keep replies consistent and traceable. For operations teams, platforms like virtualworkforce.ai show how AI agents can label intent, ground responses in ERP systems, and push structured data back into systems. This improves handling time and prevents lost context. Also, firms can use AI to enforce enterprise controls and audit trails while keeping compliance front and center. The result is fewer missed requests and a clearer record for compliance reviews.

Moreover, studies and market reports predict rapid growth in AI-powered email solutions, driven by the need to increase productivity, improve communication, and reduce time spent on email management Raportul pieței asistenților de email alimentați de AI 2025. Therefore, financial institutions that adopt an assistant for financial use cases can scale client service without simply hiring more staff. For a practical example and ROI framing, see a logistics ROI case that explains measurable savings and consistent outcomes with enterprise controls virtualworkforce.ai ROI (logistică).

AI automation frees advisors from repetitive email tasks. First, an AI email assistant for financial teams can sort inbound messages, prioritise client requests, and draft suggested replies. Also, this process saves time and reduces errors from manual data entry. For many advisory teams, automating those basic steps means advisors can focus on financial planning and client strategy rather than routing and admin. The tool also flags urgent items for human review and creates a clear escalation path.

Next, common savings come from automatic summarisation and structured note-taking. The assistant creates CRM entries and meeting notes from threads and attachments. Then, it reduces duplicate data entry and speeds meeting prep. Advisors who adopt a purpose-built meeting assistant see faster meeting prep and cleaner records. Also, systems that connect to a firm’s CRM let teams push date_client and recaps directly into records. This keeps the CRM up to date and reduces time spent on low-value tasks.

For compliance, AI provides suggested replies that advisors can approve before sending. This saves advisors time while keeping audit trails intact. Also, an assistant for financial advisors can auto-flag high-priority client emails and produce suggested replies for compliance review. In practice, wealth managers and registered investment advisors can save hours per week, which increases client-facing hours and improves client service. For operational teams that need end-to-end email lifecycle automation, see how an email tool automates drafting and resolution to shorten handling times caz de corespondență logistică automatizată.

customizable email templates, note-taking and compliance for financial advisor teams

Customizable email templates standardise communication and reduce compliance risk. First, enterprise-grade templates let teams apply approved language while allowing limited personalization where regulations permit. Also, a single template reduces the chance of inconsistent messaging across advisors and channels. The template approach supports marketing controls and audit trails for email marketing campaigns. For firms that run email campaigns, linking templates to approval workflows ensures every campaign follows policy.

Next, note-taking turns long email threads into structured records. AI-driven note-taking extracts action items, meeting notes, and client preferences. Then, it writes CRM entries and attaches the original thread for context. This reduces manual data entry and keeps client histories accurate. Also, automated summaries help financial planners and financial advisors prep for calls with a quick recap of prior messages and life events. The process increases personalization without additional admin work.

Compliance features must include role-based access, encryption, and data loss prevention. For financial services companies, these controls protect client_data and support regulatory requirements such as GDPR and Regulation S‑P. Also, audit logs and immutable trails make it easier to show what was sent, when, and by whom. Firms can integrate approvals into the workflow so any personalized email goes through compliance review before sending. For teams that need a purpose-built approach to email and operational inboxes, see how to scale operations without hiring and maintain traceability cum să-ți extinzi operațiunile logistice fără a angaja personal.

Drowning in emails?

Here’s your way out

Save hours every day as AI Agents label and draft emails directly in Outlook or Gmail, giving your team more time to focus on high-value work.

integrate and workflow: integrating an AI email tool into end-to-end advisory workflows

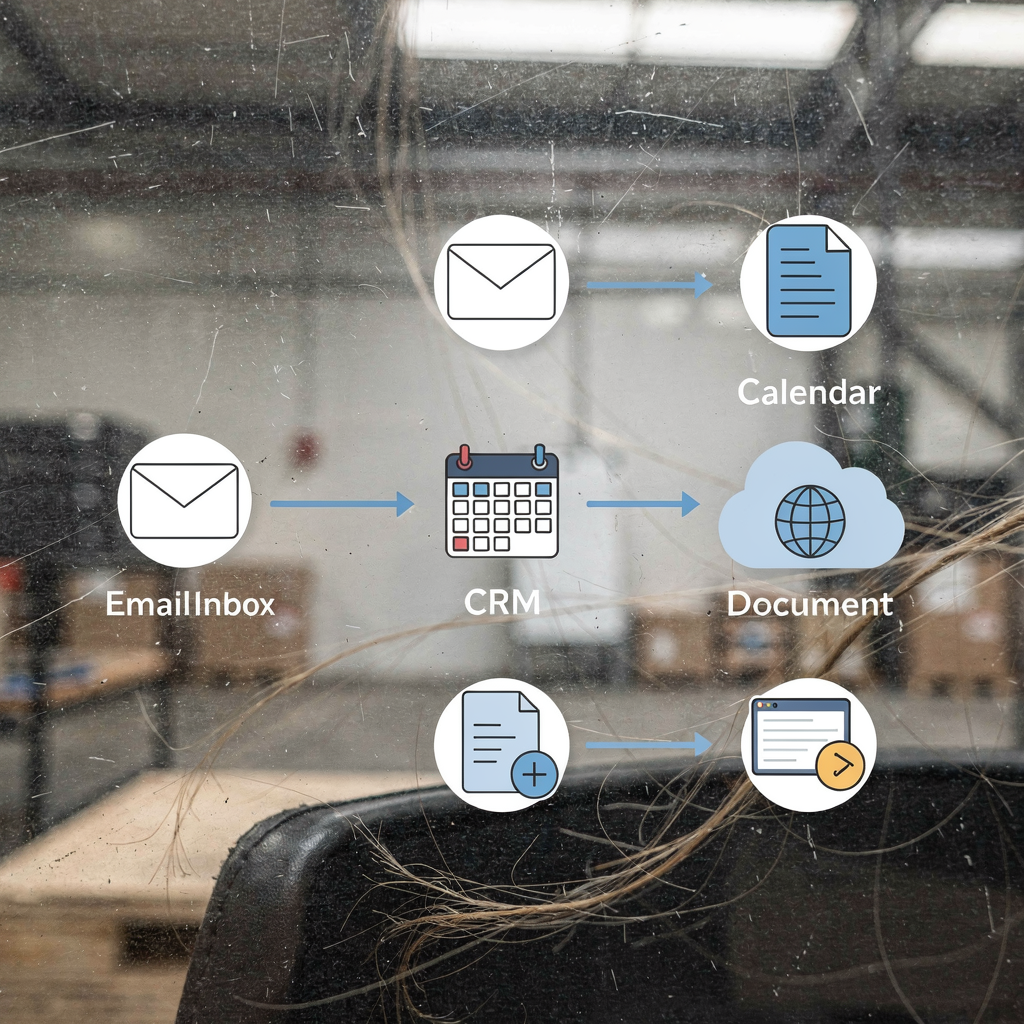

Integration matters. First, connect the email tool to CRM, calendar, client portals, and document stores. This creates a bi-directional flow so the assistant can pull financial data and push updates back to the CRM. Also, preserving audit logs during integration is critical for compliance reviews. The best integrations support enterprise-grade connectors or APIs and avoid brittle point-to-point links. They also make it simple to map data flows for onboarding new advisors and clients.

Next, workflow automation helps reduce manual handoffs. For example, the email tool can trigger onboarding checklists, KYC reminders, or followup tasks based on message intent. Then, it routes tasks to the right person or resolves them automatically if rules and data allow. This saves time and keeps cases from falling through ownership gaps. Also, linking document stores enables the assistant to attach required forms or statements directly in replies, speeding client-facing processes.

Integration should be traceable and policy-driven. Use connectors that keep a clear roadmap of who accessed what and when. Also, prefer solutions that support pre-built templates for routing and policy enforcement so teams can scale without repeated engineering. For firms curious about technology choices, consider a purpose-built platform that automates the full email lifecycle and maintains thread-aware memory for shared inboxes. That approach streamlines operations and keeps the focus on client service.

ROI and measurable impact for financial advisory firms and financial services companies

Measuring ROI starts with simple metrics. First, track time saved per advisor and reduction in response times. Also, measure the increase in client-facing hours and the decrease in errors or missed tasks. Firms that implement AI-powered email tools often benchmark baseline email volumes and time-per-email to forecast savings. For example, operations teams commonly reduce handling time from about 4.5 minutes to 1.5 minutes per email after full automation, which translates into substantial labor savings over time.

Next, track conversion and retention effects from improved personalization and timely replies. Also, measure downstream benefits like faster onboarding and fewer compliance incidents. Use A/B testing for email_campaigns and email marketing for financial segments to quantify the lift from personalized email outreach. That data helps justify broader rollouts and clarifies where to focus automation for financial returns.

Market context supports investment. Industry reports predict significant expansion in AI email assistant markets as firms chase productivity gains and better client service Raportul pieței asistenților de email alimentați de AI 2025. Therefore, building a clear ROI model with conservative estimates of save time per advisor and expected improvements in client_service will guide adoption. For firms that want practical examples of ROI and rollout patterns in operations, review case studies that compare manual handling to automated correspondence virtualworkforce.ai ROI (logistică). Also, think of the wider business case: freeing advisors from admin increases AUM focus and improves financial well-being for clients.

Drowning in emails?

Here’s your way out

Save hours every day as AI Agents label and draft emails directly in Outlook or Gmail, giving your team more time to focus on high-value work.

implementation checklist: secure, customizable, industry-specific best practice for using AI in email and email marketing campaigns

Pre-launch steps matter. First, perform a risk assessment and map data flows. Also, confirm regulatory consents and ensure encryption and DLP are in place. Next, choose enterprise-grade security controls and define access roles. For onboarding, prepare training materials and a pilot plan. Then, select a pilot group of advisors or teams and run a limited test to gather feedback and measure time savings.

Configuration requires building customizable email templates and approval workflows. Also, tune note-taking rules to match client segments and compliance needs. Set rules for personalized email so every use of personalization goes through the right checks. Next, create meeting prep bundles that include meeting notes and action items. Also, define policies for data entry and CRM writes so the system updates records consistently.

Rollout and governance must include continuous monitoring, training, and a documented policy. First, pilot and measure metrics such as time saved, response speed, and compliance incidents. Also, scale gradually and maintain a roadmap for integration and enhancements. For firms that need to automate email in specific operational areas, consider tools that provide zero-code setup, thread-aware memory, and deep grounding in operational systems. That approach reduces friction and keeps admins in control while giving advisors more time to advise.

FAQ

What is an AI email assistant and how does it work for financial teams?

An AI email assistant uses natural language processing to read and classify inbound messages. Then, it routes, drafts replies, or resolves messages based on business rules and connected data sources.

Can AI reduce the time advisors spend on email?

Yes. AI can sort, prioritise, and draft replies, which reduces time spent on admin. Advisors can then spend more time on strategic client work.

How does the assistant handle compliance and audit trails?

Solutions include role-based access, encryption, and immutable logs. Also, approval workflows ensure personalised replies pass through compliance before sending.

Will AI update our CRM automatically?

Many systems write structured data back to CRM to avoid duplicate data entry. This keeps records current and improves meeting prep.

Is integration with calendars and document stores necessary?

Integration is highly recommended because it enables seamless meeting prep and faster responses. It also supports attaching required documents directly in replies.

What ROI can advisory firms expect?

ROI depends on email volume and time-per-email, but firms often see large productivity gains. Tracking time saved and client-facing hours helps quantify returns.

How should firms pilot an AI email assistant?

Pilot with a small advisory team, measure time savings and compliance metrics, then scale. Use a documented rollout plan and training resources.

Can AI personalize client emails without increasing risk?

Yes, with controlled templates and approval workflows. Personalization can increase engagement while preserving compliance if properly governed.

Do smaller firms benefit from AI in email?

Smaller firms and RIA practices can benefit by reducing admin and improving response times. The same tools that help large banks scale also help smaller advisory firms save hours.

How do I choose the best AI tool for my advisory firm?

Choose a purpose-built, enterprise-grade solution that supports integrations, audit logs, and customizable templates. Also, review case studies and measure pilot results before a full rollout.

Drowning in emails?

Here’s your way out

Save hours every day as AI Agents label and draft emails directly in Outlook or Gmail, giving your team more time to focus on high-value work.